What things to look in a NFT exchange before buying or selling an NFT?

- Asked By

- Updated On:24-Mar-2022

- Replies:1

Short Answer

NFT exchanges represent the middlemen which connect a buyer of an NFT to the seller. There are some key points that you should consider while selecting a good NFT exchange. They are, Knowing about the Transaction and Platform Fees, Ensuring adequate liquidity and volume, provision of authentication and verification of sellers and buyers, as well as additional features to its users.

Detailed Answer

Are you wondering what things to consider in an exchange before purchasing & selling an NFT? Let's see to it.

Now that you know, what are Non Fungible Tokens and how to purchase them, the next question arises, How to select an NFT exchange?

In the rapidly expanding universe of metaverse and cryptocurrencies, it is difficult to find a good NFT to buy and own. There are dozens of websites that facilitate the buying and selling of these NFTs. Hence, before you make your first purchase or add new artwork to your portfolio, let's look at some of the points which you should bear in mind before selecting an NFT exchange.

What to consider before purchasing NFTs?

In order to purchase an NFT, you will require an exchange that connects the buyers and sellers to transact their NFT. This exchange also acts as an escrow of your cryptocurrencies until your NFT is being bought or sold. Therefore, it is essential to find a good and trustworthy exchange that will ensure your transaction goes through without any trouble.

Some of the points that you should note before you select an exchange are as follows.

1. Transaction and Exchange Fees

Whenever you buy or sell an NFT through an exchange, the platform charges a minor percentage on the overall transaction as a ‘transaction fee.’ This fee ranges from 1% to all the way up to 8-10% in some cases. Most platforms charge this fee on the selling of NFTs but there are some who also charge a service fee on the purchase of any NFT. Although these fees are nominal and would not make much of a difference on the total price, still it is important to know the extra overheads in a transaction.

2.Total Platform Participants & Liquidity

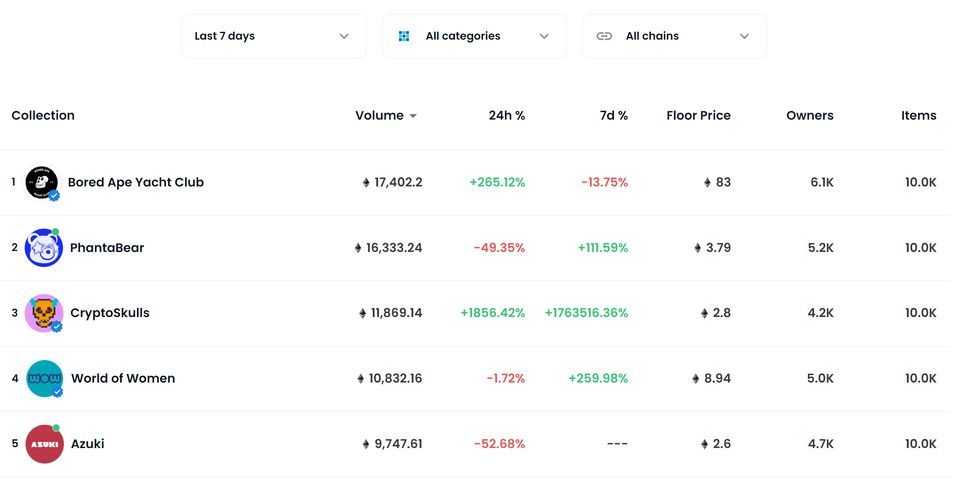

NFTs are not as liquid as other cryptocurrencies and digital investments like stocks or bonds. This means it is not easy to sell your NFT as there aren’t many buyers and sellers of the NFT. Therefore, it is important to check the total volume of transactions and the total number of users of a platform before you purchase anything from it. 'Liquidity' is extremely important because if you want to sell your NFT for any given reason, without sufficient liquidity it will be extremely difficult for you to get a reasonable price for your asset within a limited time frame. The higher the number of users and volume, the better chances of liquidity you will get.

3. Verified sellers and Users

Right now any individual can create their own artwork and mint them as NFTs. Such new entrants in the markets are in large numbers. For this reason, look out for those platforms which screen sellers and provide a verified badge with a 'Blue Tick' according to some standards. This will help you to filter out the NFTs based on the genuine sellers and purchase them accordingly. A project of a verified seller will more likely be trustable when compared to an unverified seller. However, just a verified account does not mean the project is worth investing in, but it will assist you to make a decision regarding the creator of the NFT.

4. Additional features of the platform

Apart from the other services a platform provides, as a user, you should look for platforms that offer some additional value to their users. Some of the features to look for are, Market Statistics such as total buyers and sellers in a particular NFT, Price change percentage, daily activity log of traders, total volume in a particular project, NFT ranking, and much more. These additional data will help buyers, and sellers pick good projects and segregate them from the remaining mediocre projects. It will also portray a picture on which are the top NFTs that are in demand and which are not.

Bottom Line

These were some of the major points which you would look at before purchasing or selling an NFT on a particular exchange. The NFT space is currently scaling quickly, and with that many other exchanges will emerge. Hence utilize these parameters and select the ideal platform for yourself.

Also remember the value of an NFT is determined by its underlying project, scarcity, and the demand for it in the marketplace. Therefore, once you have selected an exchange, you should conduct thorough research and analysis before you actually invest your money in any project.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

NFTs are digital assets that derive their value from the total supply, scarcity, ownership history, and usability. Some of the most expensive NFTs include 'The Merge' which was sold for a whopping $91.8 million. However, NFTs in common are extremely risky investments hence you should only allocate a small percentage of your overall portfolio towards them.

To buy and sell NFTs, you will require a crypto wallet and a good NFT exchange. The top 5 NFT marketplace includes Open Sea, Rarible, WazirX NFT platform, Axie Marketplace, and Nifty Gateway. As NFTs are highly speculative, you should identify your necessities and then choose a platform accordingly.

NFTs are digital assets in the form of photos, videos, audio, etc. These can be purchased and sold over any NFT exchange with the help of cryptocurrencies. Some of the key ways through which you can make money from NFTs are, by flipping which means buying low and selling it high. Creators of NFTs can receive royalties on the sale of their NFT. Apart from this, you can stake your NFT to obtain additional income while still owing it.

The metaverse is a blockchain-based virtual simulation universe where one can play various characters and perform any tasks. To take exposure in this space, you can invest in Metaverse cryptocurrencies, Virtual lands, NFTs, and stocks related to the metaverse.

NFTs or Non-Fungible tokens represent digital forms of unique data in the form of photos, videos, or audio that are saved on the blockchain network. This provides proof of ownership and bragging rights to the owner of the NFT. These can be traded or sold to other individuals, and the transaction can be verified, as the blockchain is a public ledger.

The Metaverse represents a digital universe integrated with various factors like virtual reality, NFTs, interactive gaming, etc. Although the possibilities of a metaverse are endless, an individual can hang around anonymously, play games, earn cryptocurrencies and spend it in the real world with the help of swapping the currencies.

NFTs represent a great way to obtain multiple benefits from the underlying digital asset like photos, videos, audio, etc. Some of the steps to own an NFT is, to research and find out good NFT projects. To select a credible NFT marketplace and get a cryptocurrency wallet along with the required cryptocurrencies to facilitate the purchase.

Crypto coins and tokens are digital assets that have few similarities and many differences. A token constitutes what you owns while a coin signifies what you are capable of owning. Let's get deeper into these two interesting crypto concepts.

Intraday trading is more risky and challenging when compared to long-term investing. Is it not a preferred option for beginners as it requires considerable capital, expertise, adequate knowledge about trading, and multiple other factors. For beginners, the best way is to deploy the majority of your capital towards long-term investments and use the remaining for hedging or short-term trading.

Market capitalisation shortly called market cap is the company’s worth, its ranking and the relative size in an industry or sector. Market cap can affect stock prices, let's see how it is possible.