How to make money from NFTs?

- Asked By

- Updated On:12-Jan-2022

- Replies:1

Short Answer

NFTs are digital assets in the form of photos, videos, audio, etc. These can be purchased and sold over any NFT exchange with the help of cryptocurrencies. Some of the key ways through which you can make money from NFTs are, by flipping which means buying low and selling it high. Creators of NFTs can receive royalties on the sale of their NFT. Apart from this, you can stake your NFT to obtain additional income while still owing it.

Detailed Answer

What are NFTs?

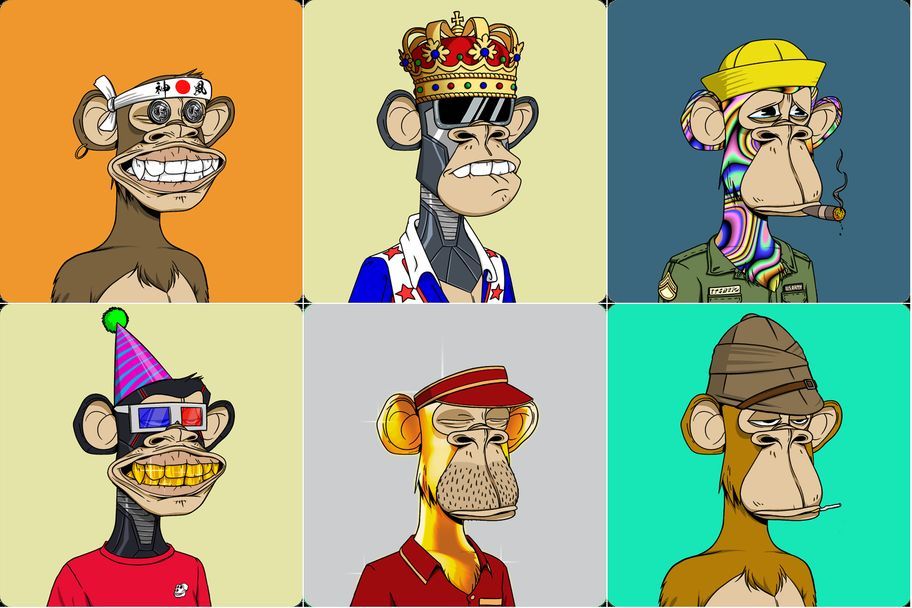

Firstly, for those who are unfamiliar with cryptocurrencies and blockchain, an NFT or Non-Fungible Token is a digital asset that is rare and has some value. These NFTs are in the form of data, stored on the blockchain network. As the blockchain is a public network, you can see it and verify it at any given point in time. NFTs are predominantly in the form of Photos, Videos, or Audio, but there are some other NFTs that are in the form of virtual objects in a metaverse. These include Land, building, and other utility objects located in the metaverse.

Any NFT uses an underlying cryptocurrency, mostly Ethereum to get registered on the blockchain. Therefore in order to buy and sell NFTs, you will need some cryptocurrency to complete the transaction. The recent cryptocurrency boom has pushed the popularity of NFTs, and even famous celebrities like Amitabh Bachchan, Yuvraj Singh, Rajinikanth, Salman Khan, and many more have come up with their own NFT collections.

How to make money using NFTs

Buying and selling is the primary method exercising which you can make money but there are some other ways, using which you can earn additional returns on your NFTs. Here are the 3 alternative methods using which you can earn money from your NFTs.

1. Buying Low and Selling High

Trading NFTs is the first way to make money. Trading an NFT is not the same as trading stocks or other securities. Here you will have to conduct intensive research to find out good projects that are available at a reasonable price. Once you have done that, you need to procure those NFTs and wait for the right opportunity to sell them at a profit. This technique of trading NFTs is known as 'flipping' and is a common strategy used by NFT traders. Most of the major NFT marketplaces include hundreds of new NFTs almost every day, therefore it is important to find out some of the good NFTs, buy them at a discounted price, and then sell them when the market realizes it's true value. This process could require weeks or months, and also there are no certainties that you will produce a positive return on your investment. Therefore conducting thorough research on the NFT is of great importance before you purchase anything. Usually, the primary sale of any NFT is the best time to purchase it. Here, you tend to get a chance to purchase it at the lowest possible price, at which it is issued by the company/individual.

2. Earning Royalties

This method is only applicable to the creators of NFTs. Most of the exchanges provide a facility to give a specified percentage on the sale of your NFTs in the form of royalty to the creators of the NFT. The royalty percentage can start from 5% and go all up to 20%. This percentage is calculated on the seeing value of the NFT and is paid directly to the owner. For example, you listed an NFT at Rs 1000 on platform X with a 10% royalty. Assume an individual purchased the NFT and resold the same at 1500. In this case, you will receive 150 which comprises 10% of 1500 as your royalty. This percentage will be paid to you every time your NFT is sold and repurchased by someone.

3. Staking your NFTs

If you are not planning to sell your NFT anytime soon and still want to get some returns out of it. On that occasion, staking remain a suitable option to get additional returns from your owned NFTs. Staking is a method where you lock your NFT with a third-party DeFi platform for a specific amount of time, through a smart contract. In return, you are offered a fixed yield, depending on the time period and also the value of your NFT. You get the returns in the native cryptocurrency of the platform.

Bottom Line

These were three of the most popular and simple ways in which you can make money using NFTs. Although there are several other complex ways like renting, yield farming, etc in which you can generate supplemental passive income from your NFT. These were some of the simpler ones.

Now before you hurry to implement any of the strategies, it is significant to know that NFTs are fairly new digital assets and it is very common to loose a lot of money trying to bet on a wrong NFT. Hence, it is critical that you do your due diligence and research before you employ your hard-earned money into any digital asset.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

To buy and sell NFTs, you will require a crypto wallet and a good NFT exchange. The top 5 NFT marketplace includes Open Sea, Rarible, WazirX NFT platform, Axie Marketplace, and Nifty Gateway. As NFTs are highly speculative, you should identify your necessities and then choose a platform accordingly.

NFTs are digital assets that derive their value from the total supply, scarcity, ownership history, and usability. Some of the most expensive NFTs include 'The Merge' which was sold for a whopping $91.8 million. However, NFTs in common are extremely risky investments hence you should only allocate a small percentage of your overall portfolio towards them.

NFTs or Non-Fungible tokens represent digital forms of unique data in the form of photos, videos, or audio that are saved on the blockchain network. This provides proof of ownership and bragging rights to the owner of the NFT. These can be traded or sold to other individuals, and the transaction can be verified, as the blockchain is a public ledger.

NFTs represent a great way to obtain multiple benefits from the underlying digital asset like photos, videos, audio, etc. Some of the steps to own an NFT is, to research and find out good NFT projects. To select a credible NFT marketplace and get a cryptocurrency wallet along with the required cryptocurrencies to facilitate the purchase.

The metaverse is a blockchain-based virtual simulation universe where one can play various characters and perform any tasks. To take exposure in this space, you can invest in Metaverse cryptocurrencies, Virtual lands, NFTs, and stocks related to the metaverse.

The Metaverse represents a digital universe integrated with various factors like virtual reality, NFTs, interactive gaming, etc. Although the possibilities of a metaverse are endless, an individual can hang around anonymously, play games, earn cryptocurrencies and spend it in the real world with the help of swapping the currencies.

NFT exchanges represent the middlemen which connect a buyer of an NFT to the seller. There are some key points that you should consider while selecting a good NFT exchange. They are, Knowing about the Transaction and Platform Fees, Ensuring adequate liquidity and volume, provision of authentication and verification of sellers and buyers, as well as additional features to its users.

You can get rich by investing in the metaverse if you pick the right assets and invest in them at a reasonable price. The whole concept of the Web 3.0 and Metaverse holds immense growth potential, therefore your assets will grow alongside the growth of the whole industry.

Decentralized Autonomous Organizations or DAOs are decentralized digital companies where one can invest and get extremely returns. You will need a cryptocurrency wallet, the required cryptocurrencies to invest in a DAO. As they are built on smart contracts, the chances of a loss of capital are low, however, there are other risks involved in the process.

Public Provident Fund Scheme is a saving scheme that comes with tax benefits. Ministry of Finance introduced this scheme in the year 1968. The main objective of PPF is to encourage general people to mobilize their small savings. The interest offered on these schemes are not taxable. Precisely, PPF is an investment with non-taxable returns.