How to use Opstra Options Strategy builder tool? Is Opstra a good platform for option strategy building?

- Asked By

- Updated On:22-Apr-2024

- Replies:3

Short Answer

Opstra Definedge is a platform that provides many tools and features to Derivative traders. Both Options as well as Future traders can make use of this platform. Some of the primary tools of Opstra are the Strategy Builder, IV (Implied Volatility) chart, Options Backtesting, Options Simulator, and many more. The Options Strategy Builder is one of the most intensively used tools on the platform.

Detailed Answer

What is Opstra strategy Builder?

Opstra Definedge is an online platform that provides many tools that are required for Options trading. Some of these include OI (Open Interest), Options backtesting, Option Simulator, Event calendars, etc.

How to use Opstra Strategy Builder?

Opstra is a versatile platform that offers many features. A beginner trader, as well as an advanced trader, can find useful tools in Opstra according to their needs. Let's see how to use Opstra’s Strategy Builder-

Options Strategy Builder

Opstra is mainly used to build options trading strategies. To build a strategy in Opstra the following steps can be followed-

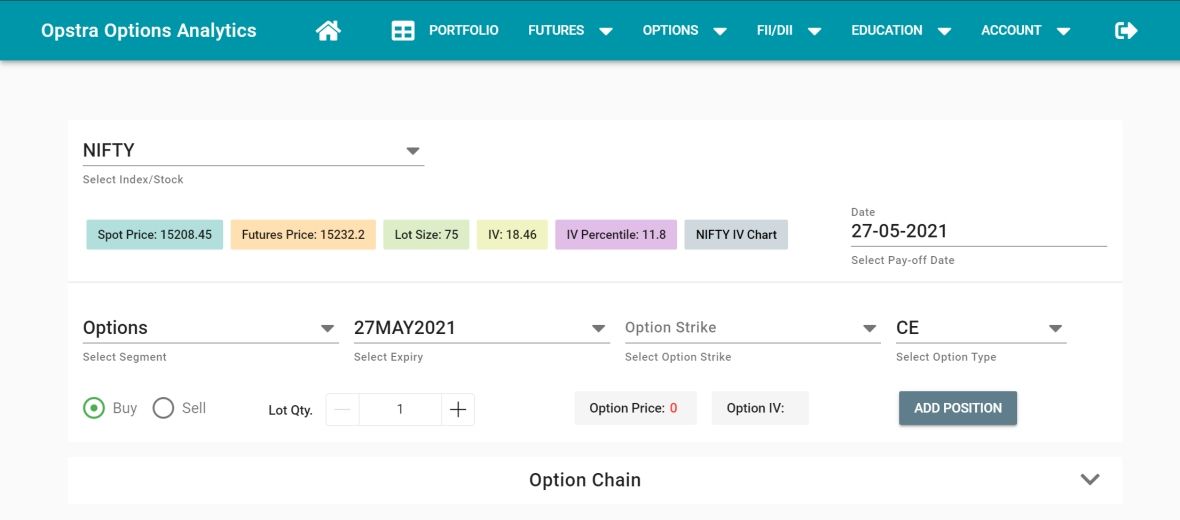

- Open Opstra Definedge, and click on the Portfolio tab on the top left hand of the platform. From there click on “Strategy Builder”. That will take you to the strategy builder part, where you can make your own strategies on any underlying. The landing page of the Strategy builder is shown below.

As seen above, The top part is to select the underlying Index or stocks, on which you want to build a Strategy. Let's take “Nifty” as an example. Some important price points such as Spot price, Futures Price, IV (Implied Volatility), IV Percentile of that particular asset will be displayed for any reference.

- Once you have decided to build a strategy, you need to select Options or Futures in which you want your strategy. If you want an option strategy then select “Options” from the “Select Segment”. After choosing the type, select the Expiry on which you want to implement your strategy. There are weekly as well as monthly expiries listed. Therefore you can use any expiry option according to your strategy.

- After choosing the Expiry, select the strike price on which you want to select for your strategy. There are 3 types of Strike prices-, OTM (Out of the Money), ATM (At The Money), ITM (In the Money). Chose any of them accordingly.

- The next step involves selecting the type of Option that you want to execute. It can be a Call option or a Put option. Therefore choose the Call or Put option in the “Option Type”

- After you have completed selecting the strike price and the type (Call or Put), now you have to choose whether it's an Option Buying strategy, an Option Selling strategy, or a strategy that involves both(combination of buying and selling). After determining the type of the strategy, select “Buy” or “Sell” as. Post this step select the desired quantity and click on "Add Position" to complete the process.

For example, if you want to set up a Long Strangle, you will have to Buy 2 OTM options (Call & Put) of the same expiry of the same underlying asset. As this involves 2 Option contracts, you will have to add one option and repeat the same process twice to add the other Option contract. After completing the process, you will be able to monitor the profit & Loss, Payoff Graph, Option Greeks, etc.

Conclusion

To conclude it can be said that building Option Strategies on Opstra is very easy. Even a beginner can create their own strategies and test them on Opstra. The Strategy Builder is also icluded on the Free plan which is free to use. This makes it even more appealing for Options traders.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (2)

Creating a strategy on Opstra strategy builder is quite a straightforward process. However, do try to tweak it here and there to maintain its integrity over time. Also, do figure out the type of plan you pick up to get the most of what it has to offer.

In this current day and age, options trading has become the new cool thing that everyone wants to try. There are many option trading platforms out there that provide various Option trading tools. Sensibull and Opstra Definege are 2 of the most prominent names in the industry.

Both of them provide all the necessary tools like OI (Open Interest) Charts, PCR (Put-call Ratio), IV (Implied Volatility) chart, etc. But the main question lies, which one of them is a better platform for Options trading. Let's find the answer to that question.

Sensibull is the better choice for beginners due to its easy interface, education tools, and broker integration. Opstra is ideal for advanced traders needing deep analytics, intraday data, and backtesting features. The right platform depends on your experience level and how data-driven your trading style is.

Opstra Options Strategy builder is a platform for Options and Futures traders. It provides many tools for trading derivatives, Some of these include Options Simulator, Options backtesting, IV (Implied Volatility) Chart, Option Chain analysis, and much more. Both beginners, as well as advanced traders, can use this platform as it offers all the necessary features for both these groups.

As more and more people try their hand in Options trading, the demand for good Options trading and analytics platforms is on the rise. There are many online options trading platforms out there. Know if Quantsapp is a good online Options Analytics platform.

Compare Quantsapp vs Sensibull, their features, pricing, tools & pros and cons. Find out which options trading platform suits beginners or advanced traders in 2025.Identify what are the differences, similarities, and which one is best for option traders.

Open Interest analysis is a major part when it comes to Options Trading. A good options trader analysis the Open Interest buildup and change to determine the market sentiment and general direction of the market. There are many platforms that offer the feature of OI analysis. Quantsapp and Opstra Definedge are two prominent participants in this field. Know which is better for you.

Fincash is a yet another online investing platform that was started in 2016 or you can call it a fintech startup. Having raised funding, it has grown fast to give tough competition to other market players.

Quantsapp is an online Options analytics platform that provides many tools and features to option traders. It is free to use, but not completely. There are two price models that it offers at present. Both of them provide access to different features and tools. This gives an individual to choose anyone according to their preferences.

The Metaverse represents a digital universe integrated with various factors like virtual reality, NFTs, interactive gaming, etc. Although the possibilities of a metaverse are endless, an individual can hang around anonymously, play games, earn cryptocurrencies and spend it in the real world with the help of swapping the currencies.

Quantsapp is an online Analytics platform that provides various tools for Options and Derivatives traders. Quantsapp proprietarily provides various solutions to option traders in order to increase their profitability. One of its unique indictors is the "Trap Indicator" which helps traders identify opportunities based on the trap situations created in the markets. Discover how it can be utilized.

Rishika Agarwal

Opstra Definegde is a platform which offers various tools which makes it easier for the traders to understand and analyze the charts and tables. It is very simple and straight process to build a strategy. It is also available for the free users making feasible for its customers.