What is the difference between Listed vs Unlisted Stocks?

- Asked By

- Updated On:26-May-2021

- Replies:7

Short Answer

Listed and unlisted are the two types of stocks in which listed can be described as the ones registered in stock exchanges while unlisted is not registered.

Detailed Answer

A stock is a type of protection that suggests the holder owns a certain percentage of the listed firm. Stocks are the backbone of virtually any portfolio and are purchased and sold mostly on stock markets, while private sales are possible. "Shares" are the units of stock. These activities must comply with government laws designed to protect stakeholders from deceptive practices. Organizations do not own investors; investors own shares issued by companies. There are two main types of stocks and those are:

- Listed stocks

- Unlisted stocks

Listed stocks:

- These are the stocks which are officially included in the stock exchanges i.e., NSE and BSE and open for the traders in the public.

- Traders can purchase or sell the shares in the stock market using a brokerage account or demat account.

- Only public companies are under listed stocks.

- It must abide to the broker's listing conditions, which may include the number of shares offered and a sufficient earnings ratio.

- These exchanges list the shares which are of high quality and are of high reputation.

- Such exchanges usually only allow high quality stocks to be traded because their reputation also plays a role in it.

- There are various requirements to be listed under stock exchange such as the number of shares to be issued, price of share, equity, etc.

- This also provides high liquidity and price of the shares are translucent.

- There are strict instructions to be listed in stock exchanges and all the rules are to be abided.

Unlisted stocks:

- These are the stocks which are not included in any sort of stock exchanges or IPO- Initial Public Offerings.

- These companies can be privately owned or public limited.

- They are only traded (purchase and sell) over the counter and not by any stock exchanges.

- They are even called OTC (over the counter) securities.

- These stocks are comparatively less liquid and instable when compared to listed stocks.

- Pink sheets or the OTCBB may be used to track unlisted stocks.

- Not being in stock exchanges, they cannot be in get public investors.

- The key benefit of investing in this unregistered sector is that you gain access to cutting-edge companies with a high degree of innovation.

- Some of the examples of unlisted stocks are: Hero FinCorp Limited, Reliance Retail limited, Suryoday Small finance bank.

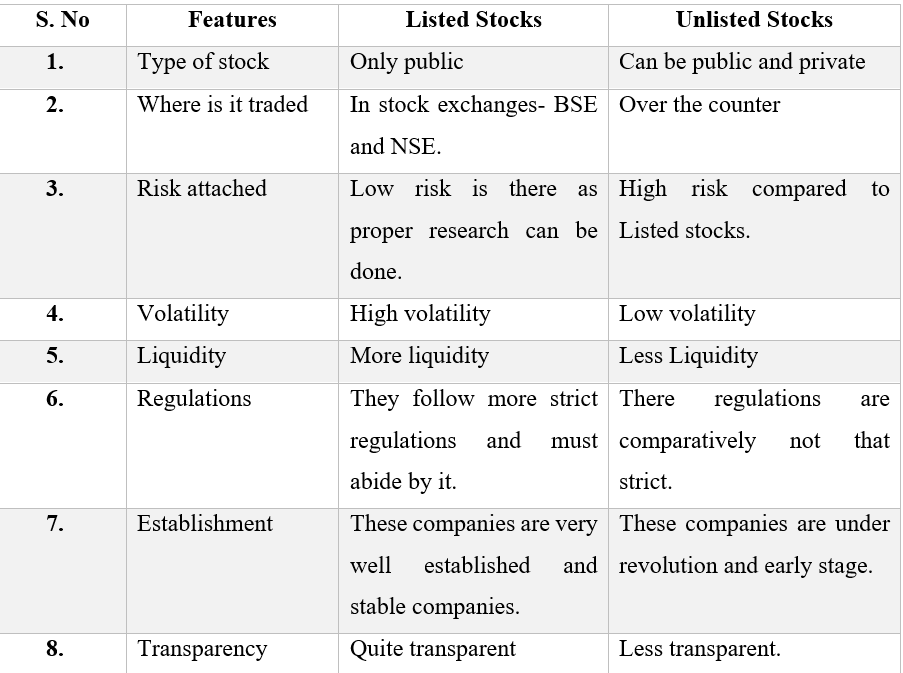

Difference between Listed and Unlisted stocks:

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (6)

We can only invest in or trade in listed stocks, not unlisted stocks, because a listed company is one whose shares are publicly traded on a stock exchange, and an unlisted company is one whose shares are generally held by private members.

A listed stock is one that a company issues through an initial public offering so that its shares can be traded on exchanges. Unlisted stocks are those that are not traded on any exchanges and cannot be traded directly. If you want to trade an unlisted stock, you must do so over the counter.

Apart from the general differences between listed and unlisted stocks, there are some other conditions on the stocks of unlisted companies. If you purchase the stocks of an unlisted company, those shares will have a lock-in period of 1 year from the date of listing. This means you can only sell the shares on the stock market, after 1 year from the IPO of the stock.

Listed stocks can be traded while unlisted cannot. Which companies list their stocks?

Listed stocks can be traded while unlisted cannot. Listed stocks are the ones that have filled for an IPO, and the SEBI has listed them. Unlisted are the ones where they are on the verge of filling an IPO and then, based on the results, then come under listed stocks.

You might have read about different stock brokers in India. Here I'll review two of the most popular discount brokers in India: 5Paisa v/s Zerodha Comparison.

Compare Quantsapp vs Sensibull, their features, pricing, tools & pros and cons. Find out which options trading platform suits beginners or advanced traders in 2025.Identify what are the differences, similarities, and which one is best for option traders.

No, both the premier stock exchanges of India - National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) do not work on Saturdays.

Contrary to popular belief, India has more stock exchanges than only the two most well-known, the NSE and BSE. There is no denying that these two stock exchanges dominate the Indian market, but according to SEBI, there are currently seven recognised stock exchanges in India.

Nifty and Sensex play a major role in the economy of the country as they list the best performing companies among all. There are various criteria that are necessary to be under Nifty and Sensex Index such as Liquidity, Market Capitalization, etc.

I was just going through some stock broker reviews. So, I thought of sharing my opinion, A side by side Comparison of two popular stock brokers: Sharekhan vs. Zerodha.

If you are into stock trading, you might have often come across the abbrevations SLM and SL. So, here we'll be clarifying: What is SLM? What is SL? You'll also know the difference, SLM vs SL with examples.

Trigger price is the price entered by a trader during stop-loss limit and stop-loss market orders. Let's understand this in detail. In Zerodha following this mechanism is really simple.

There are a number of stock brokers in India. Here we highlight two of the leading stock broking companies: Angel Broking vs Zerodha, a comparison to read.

To find good companies out of the thousand companies listen on the Indian stock exchange, you can filter stocks on the basis of certain parameters such as Market cap, Debt to Equity, Dividend payouts, Revenue and Profits growth, etc. You can easily use an online stock screener to find out these stocks.

aishwarya.frm.28

As traders and investors, I reckon we concentrate more on the performances, news, notifications and historical trends of listed stocks as only they are accessible to us.