Which is the best stock broker for beginners in India?

- Asked By

- Updated On:06-Oct-2021

- Replies:1

Short Answer

Discount brokers have gained a lot of popularity in the past couple of years. Zerodha is currently India's largest and most trusted discount broker which is also the best option for beginners. It has all the necessary qualities required for a good broker like low commissions, low-maintenance charges, high-quality trading terminal, etc.

Detailed Answer

Why do you require a stockbroker?

A stockbroker is an intermediary, that fulfills your trades and investments. You cannot buy and sell shares without a broker in India. A stockbroker allows you to trade in stocks, bonds, mutual funds, etc. A broker also provides you with a Demat and trading account, with which you can actively trade in the markets. There are many types of stockbrokers out there.

Therefore, it is important to pick the right stock broker as per your requirements

Types of stockbrokers available in India.

There are primarily two kinds of stockbrokers that offer their services in India. They are:

- Discount Broker

A Discount broker is essentially a broker who provides all the necessary features like investing and trading in stocks, bonds, mutual funds, IPOs, etc at a low cost. These brokers don’t provide additional benefits such as research reports, buy-sell recommendations, analysts reports, etc. Therefore they charge a lower commission rate.

- Full-Service Broker

A full-service broker somewhat acts as an investment advisor as it provides a broad range of services such as stock recommendations, buy-sell advice, etc. Due to all these offerings, the cost of a full-service broker is typically high. The brokerage and commissions of a full-service broker are also on the higher side when compared to a discount broker.

Which broker to select?

Now that we have learned about the different types of brokers, it all boils down to your needs. If you are a beginner who wants to explore the markets and begin your investing journey, a discount broker would be better suited for you.

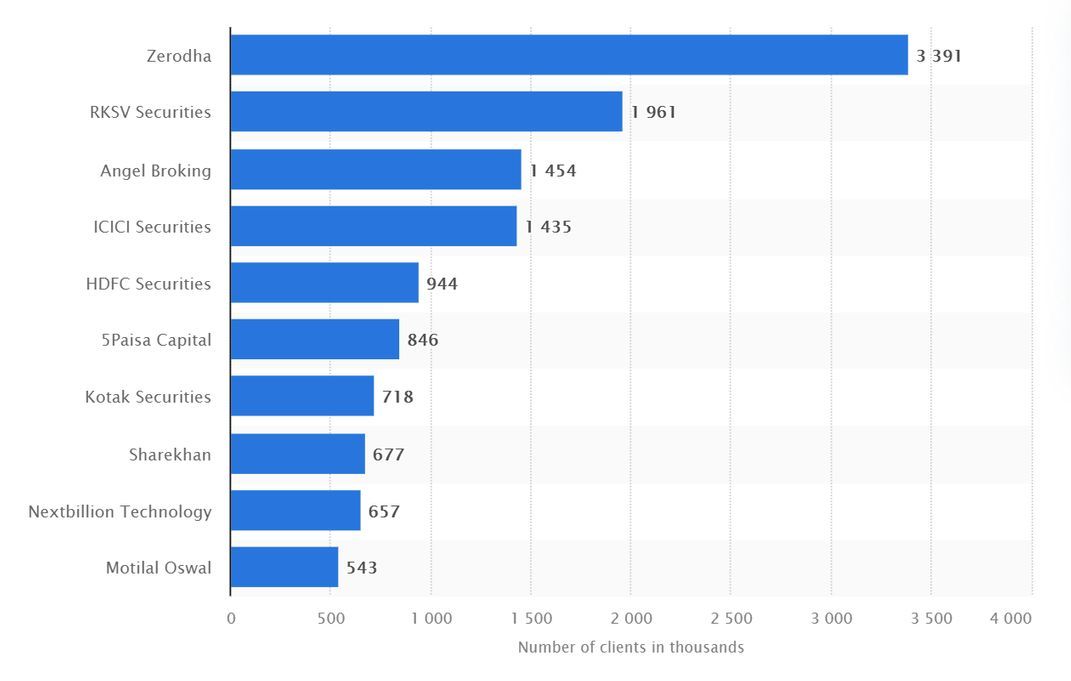

Over here is a graph of the leading stockbrokers and their total client base in thousands. This will give a fair idea of the brokers which have the largest number of clients.

In a similar way, passive investors who want to make investments for the long term could open an account with a discount broker. A discount broker will be better for beginners as the trading and account opening cost is low. Apart from this, you will get all the necessary tools and features for trading as well as investing.

Some of the key points to note while choosing a broker

1. Account opening and maintenance charges

Your Demat account is not a one-time investment as you will hold on to it for decades to come. Therefore, it is important to choose the right broker and at the right price. The opening charge is a one-time fee that some brokers charge. It can range from Rs 100 to Rs 1000. But there is a recurring fee that you will have to bear for the complete tenure you chose to have the account. Discount brokers generally charge Rs 100 to Rs 300 annually for Demat maintenance charges. But full-service brokers charge more than double than that.

2. Brokerage and other Commissions

For traders, commissions matter a lot as they typically tend to eat into the net profits. It is also good to select a broker with a lower commission bracket and minimum charges. Many brokers charge a flat fee for equity and derivatives trading. This can be adequate for traders who trade very frequently.

3. Trading terminal and mobile application

The trading terminal is equally important to an individual as the other features. The terminal of stockbroker houses all the features and tools of a broker, hence it is important to be informative and reliable. You should always look for a broker that provides all the necessary filters, order types, and fundamental tools included in the package. There are some brokers who charge extra for the indicators and other tools. Those can be prevented to save some money. Nowadays trading on the go has become popular, so a good mobile trading application is an added bonus for a broker.

4. Learning Ecosystem

Beginners might require proper guidance while beginning their investment journey. Some brokers like Zerodha provide a separate platform like Varsity for educating investors and traders about the basics of the stock market for free. Such features are an added benefit for a broker as they assist a lot for new individuals to the stock market.

Some of the best stock brokers available in India

The broking industry in India has become very competitive recently as a large number of brokers have entered the space. Some of the renowned names are Zerodha, Angel Broking, Groww, Upstox, ICICI Direct, and many more.

If you are looking for a discount broker, Zerodha can be the perfect discount broker. Currently, Zerodha is the largest discount broker in the country with over 36 lakh active clients.

Apart from being the largest broker in India, it also has one the best best mobile trading applications, ‘Kite’ and desktop application, ‘Pi.’ You also get one of the lowest brokerages in the industry, and the account maintenance is mere Rs 300 yearly.

Angel One is also a good discount broker as it offers some additional features such as weekly reports and other analysis reports frequently. It (Angel broking) used to be a full-service broker but recently got converted into a discount broker. The platform is good for beginners, but there are some drawbacks such as, you cannot directly invest in debentures or bonds and the mobile platform also offers only the basic functions.

Conclusion

By looking at all the facts and figures, it's clear that Zerodha is the best Discount Broker in India. The low brokerage and account maintenance, along with the best in class mobile and web application makes it one of the best propositions for a trader and investor. It also has a market share of more than 19% of the Indian stock market which makes it a trustworthy and reliable option.

However, if you seek more guidance with your investments and require a full-service broker. You can take a look at ICICI Direct as it offers good reports and charges decently.

For beginners, it is always recommended to start with a low brokerage and low-cost broker so that the overhead costs remain low. Once you have gained traction in the market, you can maintain multiple accounts with different stockbrokers to carry out various operations. For example, you can trade in one account and manage your investments in another account.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

I was just going through some stock broker reviews. So, I thought of sharing my opinion, A side by side Comparison of two popular stock brokers: Sharekhan vs. Zerodha.

When talking about the best stock broker in India, we cannot rule out Zerodha. It is the market leader in bargain stockbroking, is premised in Bengaluru, and accounts for more than 15% of total retail trading activity in the country. Mr. Nitin Kamath formed the leading brokerage firm in 2010 Kamath, and it now has a customer base of over 6 million.

You might have read about different stock brokers in India. Here I'll review two of the most popular discount brokers in India: 5Paisa v/s Zerodha Comparison.

You wish to know if Paytm Money is better that Zerodha or it's the other way round. Zerodha being a leading discount broker in India has been there for overe a decade now. While Paytm Money already established in mutual fund investment arena, but a fairly new entrant in stock broking industry. So, let's compare the features and discuss few details on each of them.

The best stocks for college students to invest in in India are those with strong fundamentals and high dividend yields, such as Reliance Ltd., ITC Ltd., and Infosys Ltd.

Yes, discount brokers are safe in India and can be used for trading or investing because they are all strictly regulated by SEBI. Let's find out in detail why discount brokers are safe in India.

A very basic but an important query. You can transfer share manually. You also have a procedure to transfer shares online. CDSL has the facility for transferring shares online.

Yes, you can open two demat accounts with different brokers. But, you must strictly adhere to the KYC requirements, which include providing a PAN number and providing proof of identity and address as set forth by SEBI, for each account.

A quick answer to this: Yes, Zerodha is a safe and reliable stock broker for trading and long term investment. You might have heard and read so much about Zerodha, a leading and one of the best discount broker in India. It's just amazing to know about their huge customer base and fast growing company. **Do you ever feel that Is Zerodha safe and reliable stock broker for trading and long term investment?

5paisa happens to be the second largest stock broker in the country that offers plenty of benefits and features through its Demat and trading account. Some of which include low brokerage charges of 20 rupees, paperless account opening, free trading tools, research and trading advice for free, and much more.