When should your stop you SIPs?

- Asked By

- Updated On:15-Jan-2022

- Replies:2

Short Answer

SIPs or a Systematic Investment Plan is a great tool to build money in the long run with a minimum time period of 5-10 years. It offers multiple advantages like a low minimum capital requirement, averaging benefit, formation of investing habits, etc. However, the most adequate time to stop your SIPs is when your financial goals are met or when you feel to change the objective of your investments.

Detailed Answer

What is SIP?

A SIP or a Systematic Investment Plan is a method of investing a specified sum of money at frequent intervals into an asset. A sip method of investing can be practiced in equity (mutual funds), debt (bonds), or other alternative investment options like gold or REITs (Real Estate Investment Trusts).

Investing through a SIP offers multiple advantages. Some of them are listed here.

1. Low capital requirement

Investing in direct equity shares requires a substantial amount of capital. Some good quality shares are over Rs 10,000 in the Indian share market. This becomes a problem if you want to gain exposure to these companies. Well by investing in Mutual Funds that own these companies, you can gain exposure to these shares indirectly. Mutual Funds also provide a SIP feature of as low as Rs 100 or Rs 500. So regardless of your income, you can start small with the help of SIPs.

2. Regular investing habit

SIPs are an effective way to build an investment discipline. It not only helps you to invest regularly but also establishes a habit of allocating your money into productive assets. With the help of a regular SIP plan, you will be able to ride the ups and downs of the market without panic. New investors often commit mistakes like panic selling or FOMO (fear of missing out) buying. These mistakes are avoided when you follow a sip.

3. Long term averaging benefit

A consistent SIP helps you to achieve your long-term goals without having to time the market. A monthly SIP allows you to take advantage of the highs and lows of every kind of market. This provides an average weighted cost on investment, therefore reducing the risk of lump-sum investing. In a lump-sum investment, you tend to take more risk as there is a risk of buying at the near-term market top. This can cause lower returns for an extended period of time.

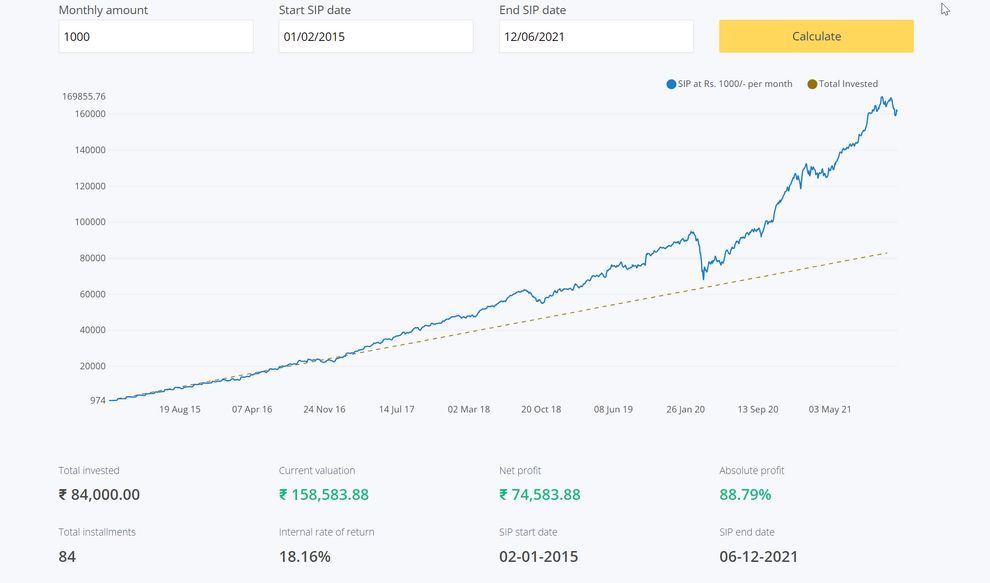

Here is a simple overview of a 5-year SIP in a Blue Chip (Large Cap) fund with a sip amount of just Rs 1,000 per month.

Even after the 2019 stock market crash, you could have generated an absolute return of 88.79%. This shows that SIPs are an excellent tool to get consistent compounded returns and it also shields you from short-term market volatility.

Best time to stop your SIPs?

Now that you have looked at some of the key advantages and features of a systematic investment plan. It is important to know when to stop them.

Before knowing when to halt or exit a mutual fund, let’s first know when you should not stop a SIP.

- The most inappropriate time to stop your SIPs is when the markets are on a downward journey. Such a scenario might evoke fear and panic, which can as a result may evoke you to stop your SIPs to prevent further losses.

This is the absolute worst time to stop your SIP as technically you are giving up free money. Whenever the markets are down, you get good companies at a significant discount. Instead of stopping your SIPs, you should double down on them to get better returns when the market returns to normal.

Now coming back to the question, “When to stop a SIP?”

Ideally, there are 2 scenarios when you can consider stopping your SIPs.

1. Completion of your financial goal

Most of your investments might be mapped to a specific purpose. It could be anything, from planning for a vacation, a house, to your retirement, etc. Once these goals are fulfilled, you can exit your SIPs and use your returns to fulfill your goals. Moreover, if you are investing in a SIP, you should have a minimum time horizon of 5-10 years so that you get the benefit of long-term compounding and rupee cost averaging.

2. Change in your objectives or fundamentals of the fund

The second reason when you should stop your SIPs is when you feel your investment objective has changed. For example, you might have a higher-risk appetite when you are young, but as you grow older your risk tolerance reduces. Hence, you can shift some of your money from riskier instruments like equity into more protected instruments like debt. To make this change you can stop your SIPs and re-balance your portfolio according to your requirements.

Another reason for you to stop your SIPs is when the fund is not performing well when compared to its peers. If you feel your selected fund is unable to beat the market or the fund manager has changed. In that case, you can consider shifting your funds to a more competent fund in your respective category.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (1)

The introduction of Systematic Investment Plan (SIP) in the mutual fund is regarded as one the major breakthrough in the financial sector. It has helped to attract a new class of investors in the sector who were not comfortable to invest a lump sum at a time.

Fixed Deposit (FD) are saving tools offered by banks to deposit lump sum amount for a fixed period of time on a higher interest rate than saving accounts. Mutual funds are investment products which pool money from numerous small investors to create a fund.

Fincash is a yet another online investing platform that was started in 2016 or you can call it a fintech startup. Having raised funding, it has grown fast to give tough competition to other market players.

Building wealth always seems to be a farfetched idea if you want it quickly. However, if you wish to build it legally, then there are different ways to build wealth. Check them out.

The best investment plans in India for a year are to invest in fixed deposits, short-term funds, and ultra-short-term funds. These are less risky and produce relatively higher returns than banks.

ELSS or Equity Linked Savings Scheme is a type of tax-saving investment instrument. It provides returns, similar to equity funds and offers a tax reduction under Section 80C. If you invest in a SIP method, every contribution towards the scheme will be considered as a separate investment and will incur a 3 year lock-in period.

Buy the Dip represent an investing strategy wherein you add on to your existing investments in the case of any small or major market correction. This strategy is beneficial for long-term investments as it helps to reduce the overall cost and also increases the overall profitability.

Navigating the huge selection of investing possibilities can be a difficult chore for middle-class people.There are a lot of options, ranging from mutual funds and fixed deposits to the National Pension System. This will give middle-class Indians a thorough insight to the finest investing strategies.

FD vs Mutual Fund vs Real Estate Investment has its advantages in terms of how much you invest and your investing period. Longer the period, higher the returns.

For a salaried class, there are many places where investments done. Know the best investment options for salaried person in India. The best investment options for a salaried person are Gold investments, PPF account, national pension scheme, ELSS, and fixed deposits.

dm.smifs

You should let your SIPs continue and only stop it when you will be needing some money in near future and continuing SIP would have hurt that goal. Otherwise, there's not much of a reason to stop your SIP.