What is difference between Fixed Deposit vs Mutual Fund? Meaning

- Asked By

- Updated On:28-Jan-2021

- Replies:4

Short Answer

Fixed Deposit (FD) are saving tools offered by banks to deposit lump sum amount for a fixed period of time on a higher interest rate than saving accounts. Mutual funds are investment products which pool money from numerous small investors to create a fund.

Detailed Answer

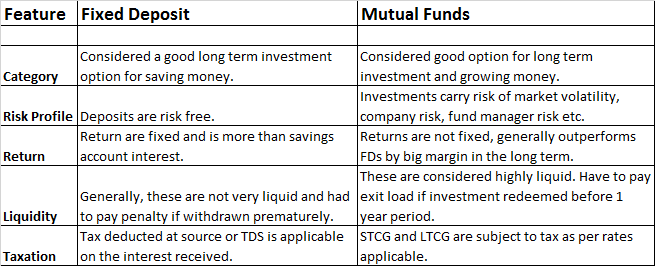

Fixed Deposit vs Mutual fund is a difficult comparison. We compare FD and Mutual Funds based on return, risk profile, investment horizon and other factors. Both of them are very different products and each has its own advantages and disadvantages.

Fixed Deposit Meaning:

Fixed Deposit (FD) are saving tools offered by banks to deposit lump sum amount for a fixed period of time on a higher interest rate than saving accounts. The interest rate offered on fixed deposits are compounded quarterly and is a risk-free saving instrument.

The tenure of fixed deposit varies from 7 days to 10 years. The interest rate offered is less for shorter duration and increases gradually for the longer duration.

Mutual Funds Meaning:

Mutual funds are investment products which pool money from numerous small investors to create a fund. The amount is invested in equity and debt instruments of companies with promising future outlook for superior return in long term period.

Mutual funds are a common choice for those investors who don't have much knowledge on stocks market or don't have the time track the market. Investment in mutual funds are considered riskier than FD and returns are subject to market volatility. It brings professional management of funds.

FD vs Mutual Funds: Risk profile

Fixed Deposit is risk-free saving instruments and is not affected by any macroeconomic event or RBI policy. There is no effect of a change in monetary policy by RBI on existing fixed deposits.

Mutual Funds carry risk on investment. Different fund type has different categories of risk. Like Equity funds contains higher risk than Balanced Funds and Balanced Funds are riskier than Debt funds. There are various risk factors in a Mutual fund, like:

- Market Risk

- Sectoral Risk

- Interest Rate Risk

- Company Risk

- Fund Manager Risk

FD vs Mutual Funds: Returns

Returns from fixed deposits are fixed. Interest rate of fixed deposit depends on the Repo rate, CRR, liquidity in the system. If the RBI decides to decrease Repo rate then all the new Fixed deposit that will be issued will have less interest rate. The increase in liquidity in the system also decreases the rates for FDs.

Whereas returns from a well managed mutual fund outperform the fixed deposit return by a huge margin of 10-12 percentage points over the long term. Equity mutual fund return depends on market performance and portfolio performance of the fund. Debt mutual fund's return depends on the Interest rate, interest income, and liquidity.

Fixed Deposit vs Mutual Funds: Investment Horizon

Fixed Deposits have a maturity period of deposit ranging from 7 days to maximum of 10 years. Depositors choose their maturity period depending on their fund requirements and maximum interest rate being offered in that time slab.

Investment in mutual funds is suitable for the long term period of more than 5 years to 10 years. The longer time frame will help in the compounding of investment, factor in market volatility of price and better return. Those investors with an investment horizon of short-term duration can invest in short-term debt funds suitable for 1-3 years of investment.

FD vs Mutual fund: Liquidity

Liquidity in Fixed deposit doesn't come free of cost. If a person decides to withdraw the FD amount before maturity period, then he has to pay penalty and is charged from the final amount.

Mutual funds are considered highly liquid fund. Investment redeemed before 1 year has to pay exit load of 1%. The exit load and time frame depend from fund to fund. Investment unit redeemed after one year are not charged with exit load and full value is paid to the investor.

FD vs Mutual Funds: How to Invest?

Fixed deposit are generally lump sum and one-time investment done in the bank and is linked through Saving bank account.

Investment in Mutual funds is done in two ways, either lump sum or SIP. In lump sum or one time you invest in the particular fund at a price (NAV). In Systematic Investment Plan (SIP), one can invest a small amount of money periodically into the selected mutual fund. (For example: If you select 20th of every month the Rs 1000 will be invested into the selected fund on that day's NAV)

FD & Mutual Fund: Taxation

The interest that you receive on fixed deposit, TDS is applicable on it. So, the actual return from the Fixed deposit is much less than the interest rate of FD.

Mutual Funds enjoy the benefits of taxation for long term investment. Taxation of different fund types are discussed below.

Tax obligation for investment in equity mutual fund (those fund with equity portfolio of more than 65%)

For period of more than one year: Earlier the Long term Capital Gain used to be tax free. But, now tax @10% on LTCG shall be applicable if gains exceed Rs.1 lakh in a financial year.

For less than 1 year equity funds are taxed 15% short term capital gains tax.

For Debt funds, investment for a period of 1-3 years are considered short term and it is taxed @ 10% and for more than 3 years, it is taxed 20% with the benefit of indexation.

Fixed Deposits vs Mutual Funds: Conclusion

Fixed Deposits seem to a traditional and a great option for saving money. FDs are good to protect your money from depreciation over the long term due to inflation. Fixed deposits are suitable in short term period as the investment in a short-term mutual fund with low-risk grade also gives same return. However, these may not be suitable for long-term wealth creation.

On the other hand, Mutual fund investment benefits in longer duration based on various factors like above average return, taxation benefit, liquidity. Further, the easy and convenient investment method like Systematic Investment Plan (SIP) usually attracts investors.

What do you feel? Which is better investment of the two - Fixed Deposit vs Mutual Fund? Do share thoughts below.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (3)

Fixed deposits are popular investment options offered by banks. You can deposit money for a better rate of interest as compared to savings accounts. It can be a lump sum deposit of money in fixed deposits for a particular period, which could range from 7 days to 10 years. Once you invest the money with a reliable financier, it begins earning an interest depending on the duration of the deposit. Generally, the basic defining criteria for FD is that the money invested cannot be withdrawn before maturity, however, you could withdraw after you pay a penalty. What are the features of FDs? Following are the Key features of FDs: 1. Offer stability 2. There is no risk of loss of principal 3. The market fluctuations do not affect your FDs 4. The interest rates are higher What is a mutual fund? A mutual fund is formed when capital collected from different investors is invested in company shares, stocks or bonds. Shared by thousands of investors like you, a mutual fund is managed collectively to earn the maximum possible returns. The total corpus of money that builds up is invested in various asset classes of any type, be it debt funds, liquid assets etc. The principle feature of mutual funds is that exactly like gains and rewards that are earned over the period of investment are shared by the investors in equal proportion, the losses are too. The distribution is done in accordance with their ratio of the contribution made in the corpus. What are the Types of Mutual Funds? The money in the funds is well regulated by SEBI, or the Securities and Exchange Board of India. They are generally of five types: 1. Equity funds 2. Debt funds 3. Balanced funds 4. Solution-oriented funds 5. Hybrid funds

FDs are losing their shine these days. The interest rate is not so high. Then tax is deducted. So, what we get in hand is too less. Inflation rate is so high and I don't think FDs are an ideal choice. What do you think? Am I correct in my thinking? We need to look for different investments to earn better.

You might have read about different stock brokers in India. Here I'll review two of the most popular discount brokers in India: 5Paisa v/s Zerodha Comparison.

NRIs living in the United States can invest in Indian Mutual Funds, but there are some hassles that have to be overcome. You will require an NRE, NRO, or FCRN account in order to convert the foreign currency into Indian rupees, post which you can complete the KYC and begin investing in Indian Mutual Funds.

The best investment plans in India for a year are to invest in fixed deposits, short-term funds, and ultra-short-term funds. These are less risky and produce relatively higher returns than banks.

Equity and mutual funds are perfect if you want to invest in companies while seeing your money grow in a short period. Moreover, the chances of compounding your investments are higher. But the risk associated is equally greater considering the growth of companies and their performance in offering returns. But then keeping money in the bank is the safest way to keep your earnings. But then, due to inflation and low returns on interest, that value of the money kept might be cut down drastically.

Zerodha as well as Groww, both allow investors to invest in Mutual funds. Groww does not charge any Account opening fees or Annual maintenance Charges but Zerodha charges Rs 200 for Account opening and Rs 300 for AMC. This makes Groww a cheaper and better option when it comes to investing in mutual funds.

Liquid funds, a type of mutual funds which invest in different money market instruments. The withdrawals from these funds are processed within 24 hours and that's why these are regarded as liquid assets. The fund manager gets flexibility to meet immediate redemption requests.

The introduction of Systematic Investment Plan (SIP) in the mutual fund is regarded as one the major breakthrough in the financial sector. It has helped to attract a new class of investors in the sector who were not comfortable to invest a lump sum at a time.

No, a Demat account is not required to invest in mutual funds in India. Instead, there are a number of other options, such as Asset Management Companies (AMCs) or offline distributors through which you can directly invest in mutual funds without opening a demat account.

Yes, Overseas Citizens of India (OCI) can invest in Indian mutual funds. Checkout ways how an OCI can start investing in the Indian mutual fund industry.

Whenever we talk about retirement corpus, Employee Provident Fund and Public Provident Fund come to our mind. These schemes are meant for long-term savings and support our after retirement plans. These instruments are known to be secure & steady with guaranteed earnings. You can start with small savings and end up with significant retirement corpus!

Harshil Patel

I think FD is a good option for Senior citizens since they get a good interest rate plus some extra tax saving benefit also. But, for others the interest rate you are saying 7-8% is not the actual rate. This is before tax rate. And, more interest is offered for long term FDs. Also, the real rate of return is much lesser after taxes. So, you basically get lesser in hand amount.