What happens to your Mutual Funds when there is a market meltdown?

- Asked By

- Updated On:05-Feb-2021

- Replies:2

Short Answer

Mutual funds have a wider market and perform slightly less bad than others. Although there are no up turns consequently. Moreover, investors will have to check the bounce ratio to get any returns whatsoever.

Detailed Answer

Last few years has been great going for stock markets in India, we have seen a secular bull run and probably one of the strongest bull runs in the history of the stock market. Consequently, mutual funds also had a gala time with most of them clocking great returns for their investors.

But let’s say tomorrow there is a market meltdown what will happen to the markets , so I thought let me see what happened in past and it can help us understand what might happen in future.

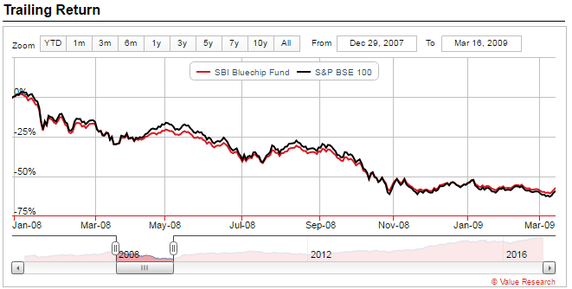

Here is the Nifty plot between Jan 2008- Mar2009

So here is the simple methodology I followed to see who mutual funds behaved during this time period. I picked up 2 funds who have consistently performed in last 10 years and tried to look at their journey during the downturn and post that and how it compared with that of wider market.

The funds I picked up are:

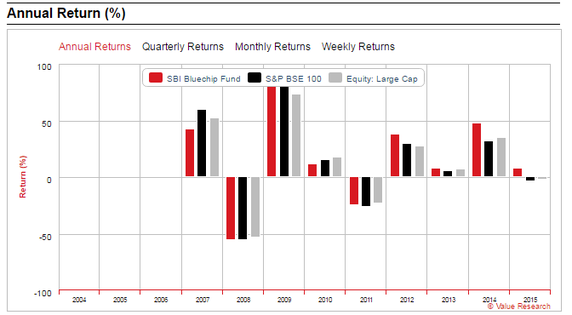

1. SBI Blue chip Fund –> Large cap

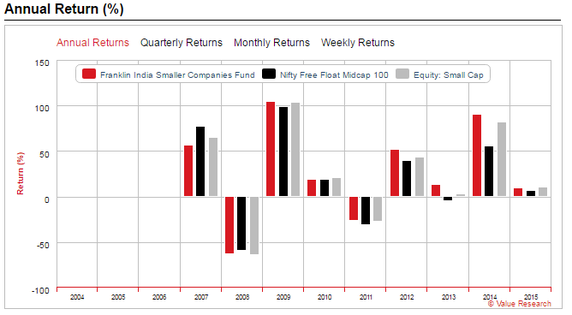

2. Franklin India Smaller companies fund –> Mid/Small Cap

Here are the Results

How SBI Blue chip performed during the period?

As you can see clearly SBI blue-chipped mirrored larger market as proxied by S&P BSE 100 during the mayhem of 2008 and 2009, but as the market bounced back it out-performed the market and since 2011 has consistently outperformed the market.

How Franklin Templeton performed during this period?

If you see again Franklin Templeton performed almost similar in the way SBI bluechip, though volatility was little high being a small cap.

Mutual Fund Performance:

So here is the summary:

- Mutual funds follow the wider market in terms of down trends and upturns

- Good Mutual funds try to perform slightly less worse in down-turn and slightly better in upturns, though it doesn’t always happen

- Mutual funds are subject to same risks as wider market and class of stocks they represent

- Important thing to look at is how they bounce back .

So, what do you think? What happens to your Mutual Funds when there is a market meltdown? Do share your views.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (1)

Mutual funds are professionally managed investment vehicles that offer numerous categories of funds to investors. To generate regular cash flows or income, investors can use the Systematic Withdrawal Plan or invest in Dividend Payout and Debt funds to receive regular income. Debt funds provide regular interest payouts, whereas dividend payout funds give regular dividends which act as regular income.

Exchange traded fund is a freely marketable security which tracks a particular index, commodity, bonds or combination of assets. they aren't popular as there is no additional tax incentives, not enough liquidity, under performs most of the time, lack of choices, lack of institutional interest, costs are low but not enough and lack of awareness.

Fund of Funds has some key advantages such as High Diversification, Low volatility, High accessibility, etc. On the other hand, it also has some drawbacks which include a High Expense ratio, low transparency, and Mediocre returns.

Funds of Funds are professionally managed funds that invest in several types of funds. Retail investors with limited capital and who are unwilling to take too much risk can invest in such funds. As FoFs are highly diversified, the overall risk is reduced for investors.

Debt funds are mutual funds managed by professionals with their money invested in high-rated securities. Just like you lend money to the bank through fixed deposit or while purchasing the bond, a certificate is issued by the borrower. Debt funds also work on the similar concept.

Fixed Deposit (FD) are saving tools offered by banks to deposit lump sum amount for a fixed period of time on a higher interest rate than saving accounts. Mutual funds are investment products which pool money from numerous small investors to create a fund.

We all look to earn good returns on the money we invest. Putting money in High return investments is one way of generating better income. The different places to get good returns are mutual funds, equity, and gold investment in India.

The introduction of Systematic Investment Plan (SIP) in the mutual fund is regarded as one the major breakthrough in the financial sector. It has helped to attract a new class of investors in the sector who were not comfortable to invest a lump sum at a time.

Fincash is a yet another online investing platform that was started in 2016 or you can call it a fintech startup. Having raised funding, it has grown fast to give tough competition to other market players.

Mutual funds are regulated by SEBI ( Securities and Exchange Board of India). SEBI regulates mutual funds as 1996 Mutual fund regulation. SEBI is also the regulator for wider capital and securities market in India. SEBI was formed in 1988 as a statutory body and drives it powers from SEBI act 1992.

shikha

People start worrying about their mutual funds when there is a meltdown in the market. It can be seen from the graphs that there is just a minor loss. But, it can recovered later when the stocks go up. So, people might be able to worry less when they stay calm and look forward to long term investing.