Are IPOs safe for investing?

- Asked By

- Updated On:04-Jun-2021

- Replies:6

Short Answer

Investing in an IPO can be considered safe as there are no major Capital Loss risks and most companies that come up with an IPO price their shares at decent valuations which gives an opportunity to the investors get the shares at a discount from the market price. Most good quality companies also give good Listing gains and good returns in a short time. Some examples are, IRCTC, Route Mobile, Burger King, etc.

Detailed Answer

What is an IPO?

An IPO is a process through which a private turns into a public company by getting listed on a Stock Exchange, for example, NSE (National Stock Exchange) or BSE. The company sells some of its Equity shares to the investor in return for the capital that they raise from the IPO.

Advantages of Investing in an IPO?

Investing in an IPO has many benefits, some of them are mentioned below-

- Gets you early access to a company:

By investing in an IPO you are considered to be one of the early investors who invested in a company. IPO’s are generally priced reasonably and good companies are rarely available at the issue price or below, after the IPO. Some of the recent examples are- IRTCT, Avenue Supermart, Happiest Minds, etc. These IPOs were listed at almost 100% premium and even after 1 year have not been traded much higher than their issue price.

- Fair Valuation:

Stocks in the Secondary market (Listed on NSE or BSE) are highly volatile and the price keeps changing every second. Therefore it is very hard to evaluate their true value and invest at decent valuations. But in the case of an IPO, the issue price offered by the company is very reasonable as they want their IPO to get fully subscribed, hence companies charge fair valuations for their stocks. In this way, one does not overpay while applying in an IPO.

- Very few chances of Extreme Capital Loss- When a person is applying for an IPO the chances of major capital erosion or loss is very small as the IPO might get listed at a discount due to some bad market conditions, Eg “SBI Cards” but over the time good quality shares do recover and trade above their issue price within a short period of time. Whereas

- Full Money is refunded in the case of Non-Allotment- While applying for an IPO the total amount gets blocked in the investor's bank and if he/she is not allotted any shares then the money is unblocked and the full money is refunded to the investor. Therefore applying for IPOs can be considered as a risk-free investment.

Is investing in an IPO safe?

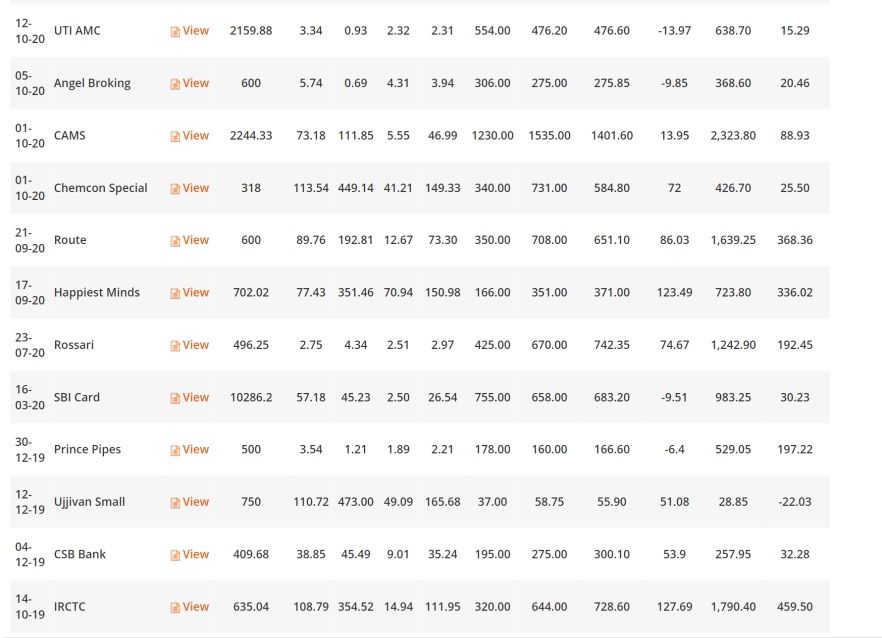

By looking at the above points it can be said that investing in an IPO is safe and comparatively safer than buying shares from the secondary market. There are no major capital depreciation risks and the complete money is refunded if one is not allotted any shares in an IPO. Here is a list of IPOs that were issued in the previous year-

As seen in the above chart out of 12 IPOs, 11 IPOs are trading above their issue price, and most of the good companies such as IRCTC, Happiest Minds, Route mobiles, etc have given more than 300% returns in the time frame of 1-2 year. Only 1 IPO in the last 2 years has failed to go above the issue price which is “Ujjivan Small Finance Bank”. This shows that good companies have a very high chance of performing well after it gets listed, hence one should definitely consider investing in an IPO.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (5)

It works well through other brokers like upstox as well.

I invest through Zerodha and it works well for me.

I have invested through Zerodha in the Past and it works perfectly well. Brokers like SBI etc are also good though

IPOs are 100% safe for investing. You just need to make sure that you are investing through the right brokerage !

Yes, Wisdom Capital is good, safe, and reliable for all stock trading and investing options. However, weighing in on the lack of trading options and the unjustified charges imposed, it is a cause of worry. But other than this, the broker is reliable enough to execute a trade from the platform.

Decentralized Autonomous Organizations or DAOs are decentralized digital companies where one can invest and get extremely returns. You will need a cryptocurrency wallet, the required cryptocurrencies to invest in a DAO. As they are built on smart contracts, the chances of a loss of capital are low, however, there are other risks involved in the process.

Digital gold is a new concept in India, which is getting popular nowadays. There are various online platforms such as Paytm, Mobikwik, PhonePe, GooglePay from where anyone can buy digital gold from as low as 1 INR.

IPOs can be a good option for beginners as they provide an opportunity to get the shares of good companies at an attractive price. Though IPOs can provide good listing gains and quick profits, good companies can help you to create massive wealth in the long term.

Yes, Groww app is completely safe for mutual fund, stock investing and trading. As a popular mutual fund investment plaftorm, Groww established itself quite well in the past few years. Now, it has also enetered the stock broking space so it's really good to see new entrants amid existing top discount brokers in India.

Yes, it is mandatory to have a PAN number to apply for an IPO since July 2006 as per Securities and exchange board of India (SEBI).

IPO or Initial Public Offering is the process through which a private company goes public by offering its shares to the public for the first time.

Yes, it is completely safe to invest your money in the stock market using Paytm money App. In fact, PayTm has come up with stock broking services recently and trying to establish itself in the said field. And, to give tough fight to top existing players it has to keep its services up to the mark. Paytm Money made a big name in mutual fund investment industry and now it's time to see its performance in the stock brokers' world.

We all look to earn good returns on the money we invest. Putting money in High return investments is one way of generating better income. The different places to get good returns are mutual funds, equity, and gold investment in India.

Yes, Bank Nifty is completely safe for investment as it represents the 12 most liquid and well-capitalized banks in India. However, due to its extreme volatility, trading in the Bank Nifty entails risk.

singh.ishwinder

I general IPOs are good and sound investment as they are vetted by SEBI but you have to take caution yourself as well