Are healthcare stocks the new best investment for significant returns?

- Asked By

- Updated On:25-May-2021

- Replies:2

Short Answer

Healthcare stocks are quite beneficial in the given day and age, all thanks to its impact on the country. They have grown in the evaluation and even providing considerable returns that nobody would have predicted. Therefore, research the stocks that you wish to invest in in the long term and see how it pans out over 10-20 years.

Detailed Answer

The current ongoing situation in the pandemic has fueled investors to jump on the trend of investing greatly into healthcare stocks. Who wouldn’t because they are under the spotlight for good reasons? Thus reaping profits from such companies in the short term might be feasible, but what about the long term? Is there any scope for any returns in the long term by investing in healthcare stocks? Let’s find out.

Types of Healthcare Stocks

1. Pharmaceuticals

These are companies that are greatly involved in manufacturing drugs and other medicines that are used daily. These could be for treatment tablets, drugs, syrups, and so on. Every company might focus on different drugs. Some might be cheap, while some might be expensive. Accordingly, their profit margins also play around based on the sales. Moreover, these include the manufacturing of vaccines as well. Such companies include Cipla, Sun pharmaceuticals, lupin, and so on.

2. Biotechnology

These are healthcare companies greatly associated with the research and development of treatments and other healthcare-associated activities. These companies manufacture and specialize in manufacturer drugs, medicines, vials, vaccines, and huge numbers. These companies involve Biocon, Serum Institute of India, Panacea Biotech, etc.

3. Medical equipment’s

The sector of manufacturing PPE kits, masks, scalpels, medical-grade tubes, and so on are manufactured by companies. It’s quite essential considering that you need a vast amount of equipment for any treatment procedures which may or may not be used based on the severity of the treatment. These companies include poly Medicure, Opto circuits, Centinal surgical suture, etc.

4. Insurance

These are companies that provide healthcare and medical insurance to people. It’s quite a vital aspect for any treatment considering that you could save up exponentially on treatments while having an insurance plan covering the treatment. Unfortunately, companies often don’t particularly associate with this single insurance offering. But then the popular ones that have their branches in offering medical and health insurance are Bajaj, Aditya Birla life insurance, etc.

5. Facilities

Facilities comprise hospitals, labs, clinics, and so on. These are institutions where all medicinal practices take place. Most of these establishments are listed in the stock market, and these companies involve Apollo, Fortis, max health care institute, and so on.

Prices of Popular Healthcare Stocks

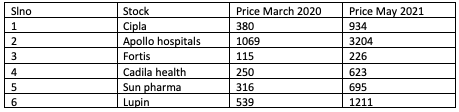

To understand how much the price deflection has occurred with popular healthcare stocks, we have provided a table illustrating various healthcare stocks and their price change from March 2020 to May 2021.

The above-given table provides an overview of the price set of these healthcare stocks before Covid hit the country and what they are trailing as of now. Ever since the pandemic hit India, these stocks have been on the bullish run and will continue to do so.

Healthcare Stocks - Pros and Cons

Healthcare stocks are a safe bet as you can never go wrong with them. Hospitals are always there to treat people and regardless of what might be going on in the country. So it’s the one institution that will continue to operate. There is no chance that people have a really strong immunity system and wouldn’t require medicinal attention anymore.

Hence, it’s a sector that will continue to grow, and riding this trend is quite feasible.

But if you look at the cons, you realize that several external factors could affect the growth of these stocks. Moreover, for the same, it could be regulatory bodies that might change certain procedures that could prove to be an indent in its growth.

Also, some political constraints could affect the company’s growth. For example, not everyone is insured, and insurance companies are getting quite cheeky in whether a person can use that insurance or not. Hence, it does prove to be a significant hurdle in the profitability of the healthcare sector.

But are Healthcare Stocks viable for the long term?

Investing in healthcare stocks alone might not seem to be a viable decision. But then allocating 20%-30% of your portfolio to these stocks should do the trick.

However, never go into individual stocks. If you have the time and patience to carry out fundamental analysis on these stocks, do ahead. If not, you can pick out a mutual fund that deals exclusively in this.

Also, keep in mind that a correction in prices of these stocks might come shortly, but till then, the bullish trend of these stocks and other healthcare stocks are bound to suffice in the long term.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (1)

There are several questions that one can ask your advisor. These questions include whether its good time to enter or exit the market? Should in exit from debt and move to FD? do I continue my SIP portfolio? and other such questions.

There are various terms that play a huge role in determining how to choose stocks for long term investment such as P/E ratio, dividend consistency, etc. For a more elaborative information head below and read the explanation given for better understanding.

SIPs or a Systematic Investment Plan is a great tool to build money in the long run with a minimum time period of 5-10 years. It offers multiple advantages like a low minimum capital requirement, averaging benefit, formation of investing habits, etc. However, the most adequate time to stop your SIPs is when your financial goals are met or when you feel to change the objective of your investments.

For a salaried class, there are many places where investments done. Know the best investment options for salaried person in India. The best investment options for a salaried person are Gold investments, PPF account, national pension scheme, ELSS, and fixed deposits.

One can either invest in bluechip companies or research extensively on the companies they feel would give returns. It also comes down to the type of investment they are ready to make. Hence, figuring out the different companies could take time, experience, and research.

Undertaking fundamental analysis and proper research is essential before investing in any particular stock. Apart from this, you should also consider asking seven key questions like 'What does the company do', 'How is it placed among its peers', 'How is the management of the company', etc before investing in it.

The introduction of Systematic Investment Plan (SIP) in the mutual fund is regarded as one the major breakthrough in the financial sector. It has helped to attract a new class of investors in the sector who were not comfortable to invest a lump sum at a time.

The Mirae Asset NYSE FANG Plus ETF Fund is a good option for Investors who want foreign exposure. The Equity allocation is very concentrated to just 10 stocks which makes this ETF very volatile and risky. This ETF consists of the top 10 stocks in their respective sectors mostly TECH, like Amazon, Netflix. Facebook, etc. Hence Investors with high-risk tolerance and a long time period should consider this fund.

For significant returns, one can look forward towards stock funds, real estate investments, dividend stocks, target-date funds and so on. Each one of these investments does offer something better to investors based on their capital of investments made.

Arbitrage Funds are mutual funds with an objective to profit from inefficiency in the price of securities in two different markets. We look at their taxation, meaning and difference with liquid funds in this post. The fund invests in equity and debt instruments.

Harshil Patel

Well, its quite a controversial topic as these are turning out to be a hot stock for many; they have seen exponential growth in recent times. However, in the long run, conducting fundamental analysis on seeing where they might be in the next 5-10 years should help find relevant answers.