Which is the best bank for GIC in Canada for international students? How many banks in Canada provide a GIC option?

- Asked By

- Updated On:02-Apr-2024

- Replies:1

Short Answer

Our analysis suggests that CIBC is one of the best bank for GIC in Canada for international students. Learn why it is the top bank for GICs and the alternatives available.

Detailed Answer

What is a GIC in Canada?

A GIC stands for a Guaranteed Investment Certificate. It is a highly liquid bank account that provides shelter to your funds, whilst offering a stable and assured rate of returns for the agreed time span (mostly short-term). It is essential for the international students who arrive in Canada to open a GIC for two main reasons:

- To support their living expenses while they pursue their studies.

- The Canadian embassy necessitates the students to disclose proof of sufficient funds.

Who are international students?

By international students, we mean non-Canadian students who enroll themselves in study courses in Canada that fall within Students Direct Stream (SDS).

Is GIC compulsory for international students?

Yes, the Canadian embassy and the government require international students to maintain a minimum balance of 10,000 Canadian dollars with a registered and approved Canadian bank, to procure a student visa or a study permit under Student Partnership Program (SPP).

Opening GIC in Canada -Things to consider before choosing a service provider

- Application mode – online or offline

- Fund opening processing fee

- Lock-in period

- Interest rate

- Refund processing fee

- Method of transferring funds into GIC

- Does it offer services to your base country?

- Any other benefits

Also explore ways to find a Job in Canada as a New Immigrant and prepare yourself to enter the dynamic corporate world.

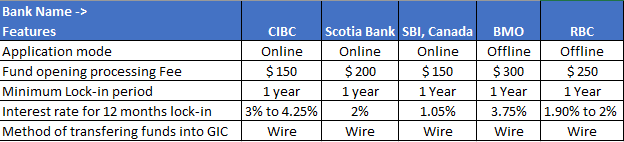

Comparison of GIC features across Canadian Banks

We have compared the features of some famous banks in Canada that offer GIC for international students:

Although there are so many banks that offer GIC in Canada, CIBC is believed to be one of the best. But before choosing you have to do a thorough research on your own about all the GIC providers. Your needs might be different than your friend’s, so choose wisely. Some of the factors that you can keep in mind before selection are interest rates, withdrawal options and fees.

Try to submit your application as early as possible. The waiting periods are long, so the earlier you submit, the faster you will get the approval. Prepare all the documents in advance and make plenty of copies for the bank and your reference in future.

Best Bank for GIC in Canada for International Students

Given its hassle-free application mode, application processing and account opening time, unlimited cost-free transactions, appealing interest rates, and student credit card feature, we believe that CIBC is the best for opening a GIC for foreign students.

Furthermore, it is open to students from China, India, the Philippines, and Vietnam. The bank has around 4000 ATMs and 1,100 bank branches across Canada and its accessibility is alluring to students who can step into any of its bank branch, in case of a grievance or emergency.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

Are you searching for the best bank or financial institution to open an RRSP account? There are various considerations you need to take into account before such as the investment option you are looking far, your market knowledge and experience, needs and goals, before finalizing the best RRSP account for you.

There are various online brokerage platforms in Canada. We believe that Questrade, Scotia iTrade and CIBC investor's edge are the best alternatives to Wealthsimple.

Yes, international Yes, international students can have two or more bank accounts in Canada as per their discretion. There is no cap on the upper limit.

The GIC (Guaranteed Investment Certificate) amount for international students in Canada is 10,200 CAD. This is a requirement for obtaining a study permit and is meant to cover living expenses during the student's stay in the country. The GIC amount must be held in a designated financial institution for the duration of the study period.

Are you planning to buy Vanguard ETF in Canada? You can open an account with the trading platform of your choice, that offers Vanguard and start investing.

Are you looking forward to buying an ETF in Canada? You simply have to open an account on the trading platform of your choice that offers ETFs and start investing.

To open a brokerage account in Canada, you’ll need to provide your full name and a valid form of a government-issued photo ID and some personal details such as your email address, phone number, residential address and Social Insurance Number (SIN).

Yes, you need a current a valid Social Insurance Number (SIN) to open a bank account in Canada, unless you are a tourist with a ‘Temporary Resident Visa’ (TRV), who wants to have an interest-free bank account.

"GIC" stands for Guaranteed Investment Certificate and is a type of investment product offered by financial institutions in Canada. Eligibility for GIC in Canada typically requires individuals to be at least 18 years old and have a Canadian address. It is important to carefully review the terms and conditions of a GIC before investing.

Based on our analysis of interest rate, fees charges, ease of managing the account and safety of funds, EQ bank is the best option in Canada to open a RRSP account.