What is PayPal inactivity fee for users in Canada?

- Asked By

- Updated On:29-Nov-2022

- Replies:1

Short Answer

If you do not log-in to your PayPal account or make transaction using your PayPal account for one year, then you will be charged $20 CAD.

Detailed Answer

What is PayPal Canada?

PayPal is an online payments platform where an individual or business can send or receive money, make online purchases and pay bills. At the time of writing, it is reported that there are around 6.4 million people who use PayPal in Canada. Many famous brands, such as Walmart, Canada Goose, Aldo, eBay, Puma etc accept PayPal. It is safe to use PayPal as it uses SSL encryption for protecting sensitive information. You only need the recipient’s email address to send money through PayPal.

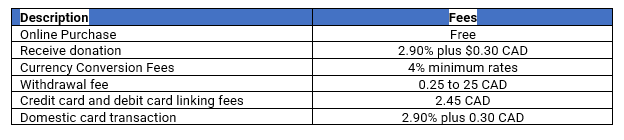

Fees structure of PayPal Canada for consumers

Paypal inactivity fee for users in Canada

It is a fee levied by online brokerage platforms, banks, credit card companies and payment platforms to users whose accounts have been dormant for a specific amount of time. If a user does not use PayPal for a long time, the service provider cannot earn and make profits, hence the payment platform compensates for its transaction costs through inactivity fees. Effective from November 20 2021, PayPal announced that inactive PayPal users must pay $20 CAD for being idle. The user will be charged an inactivity fee if they do not login to their PayPal account or do not use their account for one year.

How to avoid paying PayPal inactivity fees in Canada

- Sign-in to your PayPal account

- Shop with merchants who accept PayPal

- Send money to your family members, if you do not have any other transactions

- Withdraw money from your account

- Donate using your PayPal account

Paypal inactivity fee

Although PayPal inactivity fees are profitable for them and encourage users to use PayPal actively, it is one of the biggest drawbacks of the platform. If you foresee not using PayPal for a long time, then close your account. Before closing your PayPal account, transfer your balance out of the platform and take note of your transaction history. To close your account, sign in to your account, go to ‘Settings’, then to ‘Account options’, then click the ‘Close your account’ link. PayPal will want you to provide your bank account number for security. Once done, click the ‘Close account’ button.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

No, Venmo is not available in Canada. However, PayPal which is the owner of Venmo is accessible to the Canadian residents.

Are you a fan of WeBull, a US based stock broker and looking for similar alternatives in Canada? Grab list of best stock brokers offering various products & services.

You cannot open a TD Ameritrade account in Canada unless you are an American or have US citizenship. So, if you are a Canadian citizen, you cannot open account with this US stock broker.

Based on the bank’s presence in the US, fees, types of accounts, its security and reputation, Royal Bank of Canada seems to offer one of the best USD based bank account in Canada.

Questrade is one of the popular online brokerage firms in Canada. Learn about various ways to contact Questrade as discussed below.

Questrade is a Canadian broker offering investment-related services in Canada. One can contact Questrade through various available means including phone, email, through web chat or via branch visits. Learn about how to contact Questrade via phone, email and others.

Some of the most popular money transfer apps in Canada include PayPal, TransferWise, and Remitly, each with unique features and benefits to suit your needs. Start exploring now and find the best app for your money transfer needs in Canada.

Yes, international Yes, international students can have two or more bank accounts in Canada as per their discretion. There is no cap on the upper limit.

Neobanks are a modern-day concept of banks without physical branches which simplify banking services for individuals. Neobanks are an alternative to traditional banking services. They are advantageous in various ways as described in the following answer in detail.

In Canada, a** bank account** can be closed due to numerous reasons and through multiple ways. If your bank does not have a minimum balance, then you have to pay a fee to close the bank account.

Fees vary depending on the type of account, the products traded, and the volume of trades. For equity trades, a flat rate of CAD 0.005 per share, with a minimum of CAD 1.00 and a maximum of CAD 0.5% of the trade value. For options trades, the fee is CAD 1.00 + CAD 0.75 per contract. There is also an annual account management fee of CAD 10.00.