Is Qtrade or Questrade better?

- Asked By

- Updated On:21-Nov-2022

- Replies:1

Short Answer

Questrade seems to be a better choice unless you are interested in owning mutual funds. But, both Qtrade and Questrade have their pros and cons. So, we will be comparing both the stock trading platforms here.

Detailed Answer

Trading Platforms in Canada

TD Bank’s WebBroker was Canada’s first online stock broking platform and it was established in 1996. Since then, numerous trading platforms have emerged in Canada – both associated with bank and independent platforms. You can use these trading platforms to buy and sell shares, bonds, ETFs at the convenience of your home.

Qtrade and Questrade are one of numerous Canadian trading platforms. They are basically software that aid in trading of financial instruments.

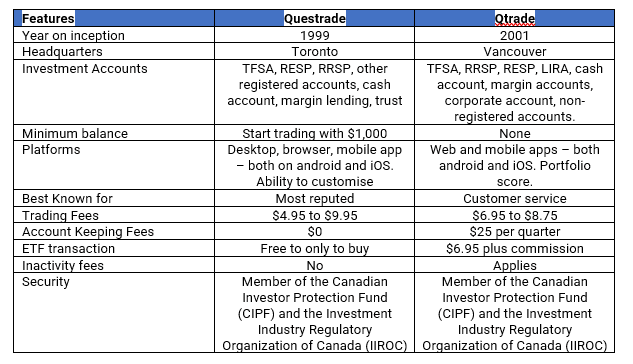

Comparison between features of Qtrade and Questrade

Is Qtrade or Questrade better?

For beginners, Questrade is better as it offers Quest wealth portfolios that are pre-built based on the risk appetite of investors.

For high volume traders, Questrade is better as it offers trades at as low as $0.01 per trade for those who transact more than 150 trades per year.

If you are someone who is interested in trading or owning ETFs then you can go for Questrade, as it is free to purchase ETFs within this platform.

Questrade offers professional advisers who can get connected with you over call to assist you with your trade.

If you are someone who is interested in mutual funds and want to have proper customer service help then Qtrade is suitable for you.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

Choosing between TFSA and RRSP depends on various factors such as your goals, time frame of investment, your marginal tax rate, age etc. Discover the similarities and differences between TFSA vs. RRSP Canada.

Wealthsimple Invest is for beginners and is fully automated, whereas Wealthsimple trade is for experts to buy and sell shares manually. Let's see which option to choose within the Wealthsimple platform.

Based on the historical data, the Canadian stock performances haven’t even gone close to the US stocks. However, nobody knows what the future holds for us.

Are you searching for the best bank or financial institution to open an RRSP account? There are various considerations you need to take into account before such as the investment option you are looking far, your market knowledge and experience, needs and goals, before finalizing the best RRSP account for you.

No, Thinkorswim is not completely free in Canada. Thinkorswim is powered by TD Ameritrade, a commission free US brokerage firm. The stock broker charges $0 commissions on online US stocks and ETFs. You have to bear some cost on option trades.

Wondering, if Qtrade is safe and legit stock broker in Canada? Know details on the leading Canadian online trading platform and see how it adds up to the security layers and keeps customers satisfied.

When we as a beginner start our journey of investing, we need to learn a lot of new things and practice them for becoming a successful investor. See if an online stock broker like Qtrade is good for beginners trading and investing in Canadian stock market.

You are required to email Qtrade at customersupport@qtrade.ca from your registered email ID. Know important details for closing your Qtrade brokerage account.

There are several choices available to Canadians who want to invest in the stock market online. Questrade ranks higher a sone of the best stock trading site for a beginner in Canada, offering access to both the Canadian and American stock markets.

In general, it is better to apply for CPP benefits when you turn age 65. However, there are some circumstances where it is better to apply for CPP at age 60. Continue reading to know what they are.