Is it better to invest in Canadian or American stocks?

- Asked By

- Updated On:29-Nov-2022

- Replies:1

Short Answer

Based on the historical data, the Canadian stock performances haven’t even gone close to the US stocks. However, nobody knows what the future holds for us.

Detailed Answer

Investing in Stocks

The investing objective across the globe is one and the same. We all give up spending a part of money today, to invest, accumulate and grow it for a greater purpose in the future. The purpose for which the stocks that are listed across the globe are also one and the same – to raise capital for the relevant company. However, the stock markets of every country differ based on its economy, political environment, supply and demand, investor sentiments, exchange rates, climate, and the current affairs brewing in the country.

US Share Market: An Overview

The United States of America is one of the powerful countries in the world, a very well-developed nation, topping in nominal gross Domestic Product and Net Wealth. There are nearly 13 stock exchanges in the US, however, the two principal exchanges are New York Stock Exchange (NYSE) and National Association of Securities Dealers Automatic Quotation System (NASDAQ). Similarly, there are nearly 5000 indices in the US, but the notable ones are S & P 500, Dow Jones Industrial Average (DJIA) and Nasdaq Composite.

Canadian Share Market: An Overview

Canada, the neighbor to the north for the Americans, is 8th largest in nominal Global Domestic Product, and ranks 3rd in availability of natural resources. The country has 3 main stock exchanges namely Toronto Stock Exchange (TSX), TSX Ventures Exchange (TSXV) and Canadian National Stock Exchange (CSE). The main stock indices of Canada are S&P/ TSX Composite Index, MSCI World and Dow Jones Industrial Average.

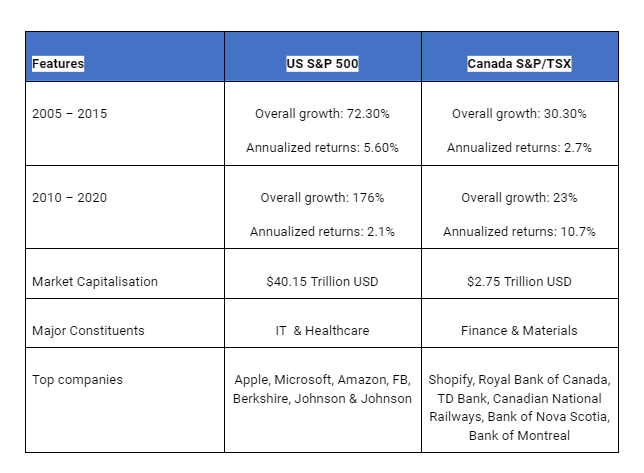

US Share Market Vs Canadian Share Market: Historical trends

US Share Market Vs Canadian Share Market: Recent happenings

Canada has abundant natural resources. At the onset of the Ukraine Russia war, the TSX witnessed new heights due to the demand for commodities. It in fact outperformed S&P 500 after 13 years. On the other side, the IT industry and US itself is looming into recession as an after effect of the COVID-19 pandemic.

US Stocks vs Canadian stocks - Which is better?

Based on the historical data, the Canadian stock performances haven’t even gone close to the US stocks. However, nobody knows what the future holds for us. One must decide their investment choice based on their country of origin, needs and objectives, investment time frame, current market trends, future speculations and risk appetite.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

Yes, Canadian stocks prove to be a shelter to investments with its wide variety of natural resources and stable banking system.

The Toronto Stock Exchange (TSX) opens Monday to Friday at 09:30 and closes at 4:00 PM Eastern Daylight Time. The trading hours of the Canada Securities Exchange (CSE) are also 09:30 AM to 4:00 PM EST.

If a person wants to expand his investment opportunities and become a part of some of the great US companies. Then yes, buying US stocks in Canada is totally worth it.

A fractional share is a small part of a company's stock which is less than one full share of the company and can be owned by an individual. An investor can buy fractional shares in Canada with platforms like Wealthsimple Trade and Interactive Brokers, etc. Go through the post to understand it completely.

Choosing between TFSA and RRSP depends on various factors such as your goals, time frame of investment, your marginal tax rate, age etc. Discover the similarities and differences between TFSA vs. RRSP Canada.

Tax-Free savings Account (TFSA), Canada can be considered the equivalent of Roth IRA, USA. Let's get into some more details on the similarities and differences, Roth IRS vs. TFSA.

There are various steps for Canadian NRI to invest in share market in India. Let's figure out how to invest in Indian stock market from Canada.

Are you a Canadian citizen wondering if you can open a bank account in USA? We have an answer to your query. Yes, Canadians are eligible to open a savings or a chequing bank account in the United States of America.

Yes, Canadians can purchase a property in the United States of America, just like any US citizen does. In fact, it is reported that the top foreign purchasers of US property are Canadians.

You cannot open a TD Ameritrade account in Canada unless you are an American or have US citizenship. So, if you are a Canadian citizen, you cannot open account with this US stock broker.