How to invest in Gold in Canada?

- Asked By

- Updated On:29-Nov-2022

- Replies:1

Short Answer

A highly liquid asset, gold is considered as one of the best alternative options to diversify your investment portfolio. You can buy gold jewels, coins, bars, mutual funds or ETFs in Canada.

Detailed Answer

Gold as an investment

Gold has been treasured and invested in, right from 4000 BC. There is no country, civilization, culture or era that has not valued gold. Back in the days, gold was used for barter system trading, then it was on an equal pedestal with US dollars and was used as an authorized tender to make purchases.

Later, a separate gold exchange was founded based on the Bretton Woods Agreement. It was after the second world war; USD became the prominent currency while gold took a back step and turned out to be an investment option.

Let’s explore the ways in which we can invest this precious yellow metal in Canada.

How to invest in Gold in Canada?

We can invest gold in both physical as well as in other forms. Let us first look into the ways we can hold gold physically.

1. Jewels

Buying gold jewelry is one of the traditional forms of investing in gold. In Canada, there are professional gold sellers who are registered under Canadian Jewelers Association, who sell gold. It is secure to make purchases with them as they are required to act in accordance with the anti-money laundering laws. Furthermore, when you intend to sell your gold jewels someday, your gold will have sufficient testimony as it was bought from a licensed dealer.

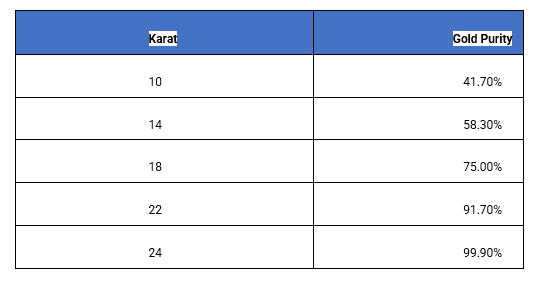

The disadvantage of investing in gold jewelry is that it is not 100% pure. It is essential for the jewel maker to alloy it, and to bring them into a desired shape or design. In addition, they incur jewel making charges, design cutting cos & wastage fees. The purity of the lustrous metal is measured in Karats as follows:

2. Coins

In Canada, you can purchase gold coins from any gold jewelry shop or pawn brokers. However, the most trusted method is procuring them from Canada Post or any of the big 5 banks or through the Royal Canadian Mint.

3. Gold Bars

The higher the purity of gold is, the higher the fructification of our investment is. Gold bars are the purest form of physical gold. Gold bullions can be purchased both online and offline. You can either purchase gold from one of the big 5 banks through its net banking facility or visit the branch in person.

Other forms of Gold Investment

Some alternate ways to invest in gold include:

Mutual Funds or Exchange Traded Funds

You can invest in mutual funds or ETFs that has exposure to gold value or the ones that track industries such as gold mines or refineries.

We have listed some best ETFs and Mutual Funds that orbits the gold markets:

- iShares Gold Bullion ETF

- CIBC Precious Metals Fund

- BMO Junior Gold Index ETF

- BMO Precious Metals Fund

- Horizons Enhanced Income Gold Producers ETF

- TD Precious Metals Fund

- iShares S&P Global Gold Index ETF

- Horizons Gold Yield ETF

Investing Gold in Canada

The ways to invest in Gold are pretty straightforward in Canada. Some deem gold to be a primitive investment option. However, one cannot deny the fact that it is one of the solid weapons to hedge against inflation. A highly liquid asset, gold is trusted across the globe and one of the best alternative options to diversify your investment portfolio.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

Are you looking forward to buying an ETF in Canada? You simply have to open an account on the trading platform of your choice that offers ETFs and start investing.

This is a tricky question and does not have an exact answer. However, an average Canadian is likely to invest less than $2,000 in stocks. This number is not fixed and may go up or down based on an individual's earning, saving, expenses and financial gaols.

Yes, banks in Canada charge various types of fee within RRSP such as account opening or closing fees, administration fees, transaction costs etc. Let's dig deeper into the different fee that banks usually charge for RRSP Canada.

There are many ways in which you can invest $100 such as robo advisor platform, fractional shares, ETFs, managed funds, crypto currency, etc. Let's discover and discuss different ways of investing an amount of 100 CAD in Canada.

Are you planning to buy Vanguard ETF in Canada? You can open an account with the trading platform of your choice, that offers Vanguard and start investing.

Are you a fan of WeBull, a US based stock broker and looking for similar alternatives in Canada? Grab list of best stock brokers offering various products & services.

Determine your objective and investment capital. Open a trading account of your choice and purchase the shares of your preference after making an analysis of the market.

There are various online brokerage platforms in Canada. We believe that Questrade, Scotia iTrade and CIBC investor's edge are the best alternatives to Wealthsimple.

The name of Canadian currency coins are as follows:

- Loonie (One dollar)

- Toonie (Two dollars)

- Quarter (25 cents)

- Dime (10 cents)

- Nickel (5 cents)

- Penny (One cent)- Phased out

While it is legal for international students to invest in cryptocurrencies in Canada, but they should be informed of the local financial rules and legislation. Like with any investment option considered, it's necessary to do your research and know the consequences before deciding