What is difference between Long term vs Short term investment?

- Asked By

- Updated On:26-May-2021

- Replies:2

Short Answer

Short term and long term investments are the two types of investments, allowing people to invest in assets which can help them to generate a profit in the future. Both are important in there own ways and it is important to diversify also. An investor needs to be mindful about investing in both.

Detailed Answer

Introduction:

Investment means any security or asset which are created with the aim to either appreciate/ increase its value of generate income. The sole purpose of investments is to generate profit, so it is important to study all the areas before purchasing or investing in any asset or investment. There are several ways to invest such as: buying and renting the buildings, investing their money in stock market, etc., which can help the individuals in the future.

Long term investments:

The investments are usually taken for duration usually more than 5 years and offer higher returns after some years. These investments are usually made by the individuals to meet some of the major goals or phases of their life. These have a lot of market speculations involved with it but also involves very high returns. Usually, such long-term investments cannot be liquidated, the investor needs to be quite patient and also monitor the market scenario depending upon their long-term investment.

There is no hurry to decide what is to be done with the investments, in case of stocks, there is no hurry to sell anything as there is ample time to decide. These investments are made as per compound interest and there is no stress because it will always be a very compact and contract based. These enable you to take advantage of favorable tax treatment and lower operating costs because these expenses will only be realized if you adjust your investments. Your costs will stay low if you quit your investments alone.

Short term investments:

These investments are usually taken for a duration less than 5 years. It involves less market risks and also can be liquated whenever needed. These investments are usually made by the individuals to meet their short-term goals and has high flexibility. It is quite a good option for individuals if they want to save their money.

These are very unpredictable and also can be tough to make judgements regarding it. Such investments usually give irregular returns as in more or less than what was expected. They allow you to take advantage of the economic data and news cycles. Specifically, in stock market, it is very difficult to determine anything in such short duration.

Some examples of short-term investments are money market accounts, certificate of deposits, treasury bills.

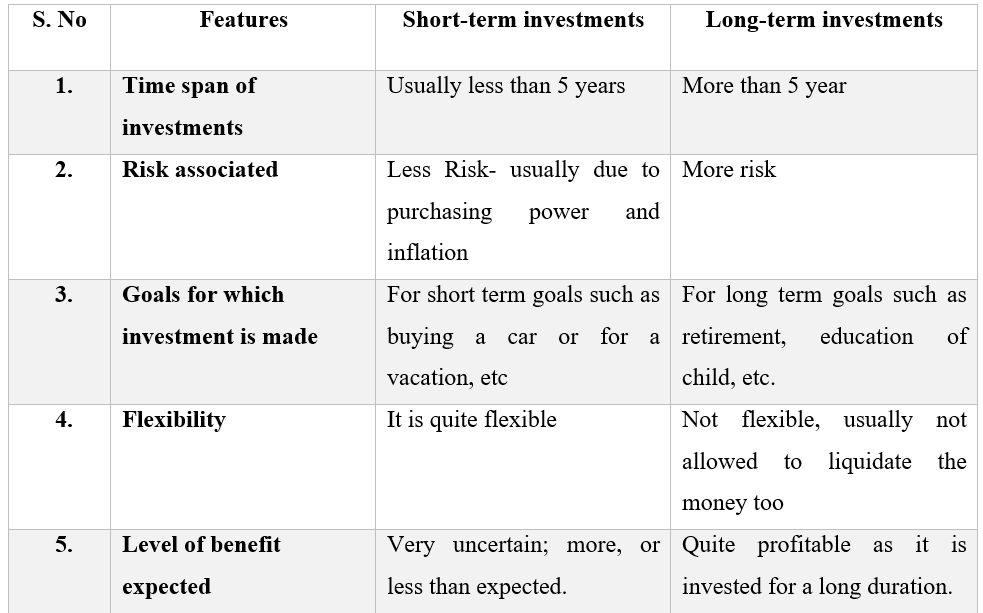

Difference between short- term investments and long-term investments:

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (1)

Fixed Deposit (FD) are saving tools offered by banks to deposit lump sum amount for a fixed period of time on a higher interest rate than saving accounts. Mutual funds are investment products which pool money from numerous small investors to create a fund.

Liquid funds, a type of mutual funds which invest in different money market instruments. The withdrawals from these funds are processed within 24 hours and that's why these are regarded as liquid assets. The fund manager gets flexibility to meet immediate redemption requests.

There are various terms that play a huge role in determining how to choose stocks for long term investment such as P/E ratio, dividend consistency, etc. For a more elaborative information head below and read the explanation given for better understanding.

Every Equity Investor should maintain some part of their portfolio diversified into foreign companies. This can be achieved through Foreign brokers or Mutual Funds and ETFs that invest in abroad markets. Investing abroad has many benefits such as exposure to the top global companies like Facebook, Amazon, Ford, etc. The tax implications on investments made outside India are different as foreign Equity is taxed as Debt Mutual Funds

No investing in stocks cannot be equated to gambling. As a newbie. someone might think so, but in reality what's the difference between investing and gambling, let's figure it out.

Who doesn't like to get rich fast? While there are several ways to do so, we have enumerated ten different ways by which getting rich fast can turn from a dream to reality.

The best investment plans in India for a year are to invest in fixed deposits, short-term funds, and ultra-short-term funds. These are less risky and produce relatively higher returns than banks.

Intraday trading is more risky and challenging when compared to long-term investing. Is it not a preferred option for beginners as it requires considerable capital, expertise, adequate knowledge about trading, and multiple other factors. For beginners, the best way is to deploy the majority of your capital towards long-term investments and use the remaining for hedging or short-term trading.

Building wealth always seems to be a farfetched idea if you want it quickly. However, if you wish to build it legally, then there are different ways to build wealth. Check them out.

There are several investing choices accessible for Indian students that might assist them in beginning their future savings. There are several options for students to build their money and make financial plans, including standard savings accounts, term deposits, and mutual funds.

Harshil Patel

Short term investments are great considering the fact that it helps in swing trading and trend trading. Long-term investments are those where you conduct fundamental analysis and then invest in the company. It's where you tend to buy for a small price and then make considerable profits over the long term of 10+ years.