Common Financial Terms & Concepts

What are Blue Chip Stocks? Meaning & Top Examples List

You must have heard this term several times on news channels, newspapers and might also have heard people talking about it that they have purchased some blue chip stocks. But what exactly are blue chip stocks! Are they the ones which are highly priced or the ones which are high-quality stocks? Let’s understand it.

What are Blue Chip Stocks?

Blue chip stocks are shares of large, well-established, and financially sound companies who have an excellent reputation.

Although the term blue chip was used by Oliver Gingold (the man who phrased this term) in his articles for highly-priced stocks, but today this term is more often used to refer to high-quality stocks. By high quality, we mean the stocks which deliver superior returns in the long run.

Blue chip companies have strong fundamentals like consistent annual revenue over a long period, stable Debt-Equity ratio, good Return on Equity (ROE) with large market capitalisation and higher P/E ratio. They most often remain a part of benchmark indices like Sensex and Nifty 50.

Blue chip companies are generally market leaders and have the capabilities to face tough market conditions. This is the reason why they always remain popular among the investors and are generally traded at higher prices on the Stock Exchanges.

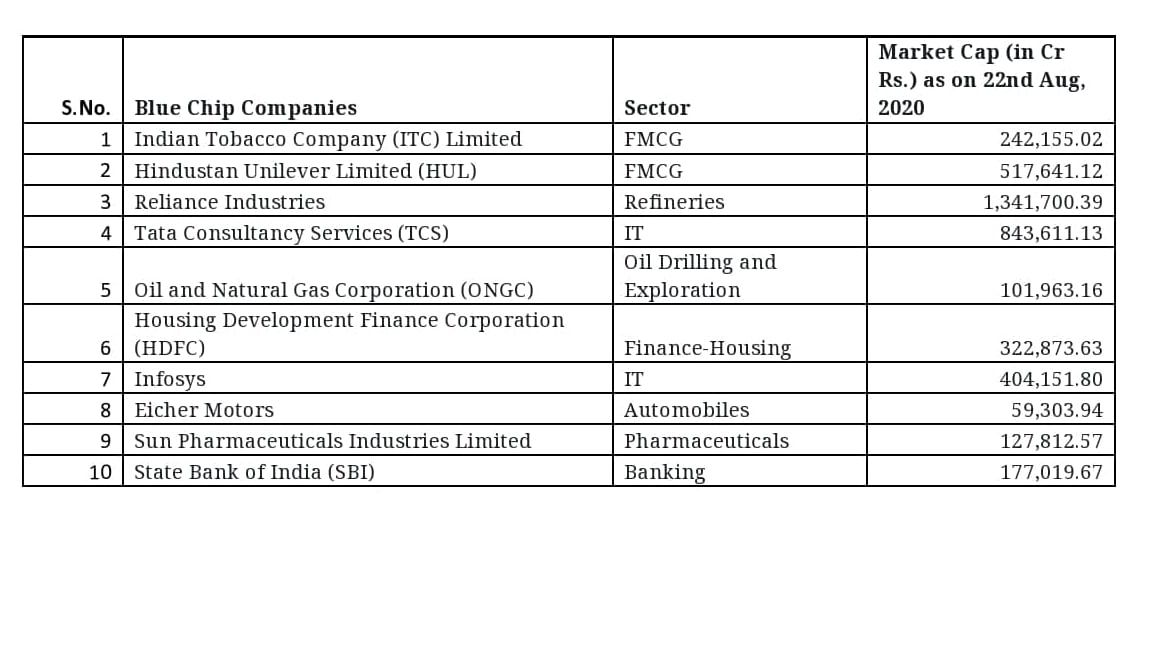

Blue Chip Stock Examples List

Examples of Blue chip stocks traded on Indian Stock Exchanges (NSE and BSE) are listed below with their sector, price and some other details.

Blue Chip Stocks: Are These Worth Buying?

Considered to be the safe haven when it comes to long-term investing, blue chip stocks are always worth buying. These companies have goodwill and brand image in the market which they got because of sheer hard work and determination. This makes the risk of your investment very low.

Consistent dividend payouts are always provided by these companies which will help you grow your wealth in the long term. These stocks have the history to beat inflation which is the favourable as many bank saving account interest rates are not even able to beat inflation which increases your opportunity costs if you park your idol money at bank.

So, when nothing is wrong with business and management, they are the best stocks to buy anytime.

What makes the value of Blue Chip stocks so high?

Exorbitant high P/E ratios of Blue Chip are for a variety of reasons. They are generally the market leaders, thus capturing large market share of an industry.

With large market share comes good returns, high credit worthiness, lower risks and more liquidity. Therefore, more and more investors prefer to put their money in blue chips which leads to high demand which further leads to high prices.