Can a Non-Resident Open an Investment Account in Canada?

- Asked By

- Updated On:29-Nov-2022

- Replies:1

Short Answer

No, you cannot open an investment account in Canada while you are a Non-resident, the exemption being - Tax-Free Savings Account (TFSA). Having said that, you can continue to hold the investment accounts that you once opened while you lived in Canada.

Detailed Answer

What is an Investment Account?

An investment account is a type of a current account, and it holds the various investments you purchase (shares, bonds, Exchange Traded Funds, and managed funds) along with cash that supports your purchase and sales.

A savings bank account is an instrument to assist your personal finances, whereas an investment account is aimed to reap higher returns and is commenced to accumulate money that is pointed towards a goal. Read more to find out if a Non-resident of Canada is eligible to open an investment account

Types of Investment Account

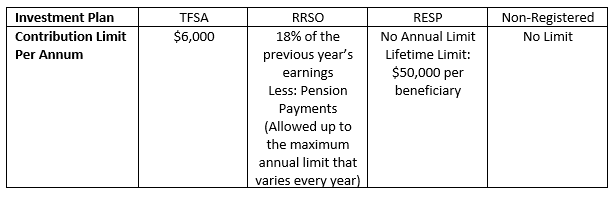

There are four types of investment accounts, based on your objectives:

A standard non-retirement brokerage account

It is a standard account that is owned by an adult. It transacts & trades in cash & investments and it is not intended to achieve any goal. This is generally tax-free and it is popularly called the Canadian Tax-Free Savings Account (TFSA).

Retirement account

The funds accumulated and invested in the account are meant to be used during the retirement phase of the owner. The well-known term for this in Canada is Registered Retirement Savings Plan (RRSP).

Education account

This account invests in shares and bonds and saves up for exclusively paying educational expenses. This is called as the Registered Education Savings Plan (RESP) in Canada.

Non-registered Investment Account

This account is used to grow your money and offers the utmost flexibility in terms of age and contribution limit.

Can a Non-Resident Open an Investment Account in Canada?

TFSA

Being a non-resident you can still open or contribute to a TFSA in Canada, however, you must be above 18 years of age and must have a valid Canadian Social Insurance Number (SIN). As the name says, TFSA is generally tax-free, however, for non-residents, the contributions made while they are away from Canada, are taxed at 1% every month the contribution stays in your investment account.

RRSP

Non-residents are generally people who once used to be a resident of a country. If you had opened an RRSP while you were in Canada, you can continue holding the same. If you have had contribution room by the time you left Canada, you can contribute to utilize the unused cap. However, you are not eligible to open a new RRSP account or to make new contributions after you have left Canada.

RESP

You cannot open a new RESP, while you are being a non-resident, however, you can continue contributing to the already opened account, given the beneficiary remains to be a Canadian citizen.

Non-registered Investment Account

Although this type of account offers pliability with respect to age, purpose, and contribution limits, a non-resident cannot open a non-registered investment account in Canada.

Investment Accounts in Canada for Non-residents

Canada has strict laws with respect non-residents opening investment accounts. This owes to the special tax treatment, access to investment markets, and investment objective of the accounts that are offered exclusively to the people who live in Canada.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

There are various online brokerage platforms in Canada. We believe that Questrade, Scotia iTrade and CIBC investor's edge are the best alternatives to Wealthsimple.

Yes, opening a Tax Free Savings Account or TFSA surely seems to be a good idea. In fact, TFSA is good for a person who is 18 years or above and is looking for long term investment.

At present, the potential to open a brokerage account in Canada, while being a non-resident is complicated and has numerous terms and conditions. This varies from broker to broker. To become savvy in this topic, continue reading.

Based on our analysis Wealthsimple is a good alternative to Questrade for its cost effectiveness and Qtrade is a good alternative for Questrade for its customer services and research tools.

Choosing between TFSA and RRSP depends on various factors such as your goals, time frame of investment, your marginal tax rate, age etc. Discover the similarities and differences between TFSA vs. RRSP Canada.

Yes, Virtual Brokers is a safe online trading platform. Let's analyze the safety and security features that make the Virtual Brokers a popular platform.

Like every other trading platform Virtual Brokers has its pros and cons. Read more to find out if the platform suits you. See if Virtual Brokers is good.

Let's analyze various investment products and see if they are tax-free in Canada. In fact, they may offer some tax benefits but it purely depends on the investment account they are held in.

Yes, now you can trade options through the Wealthsimple platform. Options trading is only available on the latest version of the Wealthsimple mobile app in your DIY accounts. You'll be able to buy or sell options in any of your self-directed trading accounts through the Wealthsimple mobile app. The best part is, there is no minimum account balance required.

No, Wealthfront is not available in Canada. It is only meant for US citizens and not for those residing outside of the U.S., including U.S. citizens residing abroad.