Are there any Canadian Trading Platforms that support Forex Trading?

- Asked By

- Updated On:29-Nov-2022

- Replies:1

Short Answer

Yes, there are numerous trading platforms in Canada that supports Forex trading. Let's learn more about forex trading and the Canadian brokers offering such services.

Detailed Answer

What is Forex trading?

Forex trading is buying and selling foreign currency. There is no physical exchange to trade Forex. However, this can be done over the counter.

The market operates round the clock as it covers every country and every market and, because of this, the volume of trade is heavy in this market, leading to high liquidity.

Having said that, since the market covers nooks and corners of the world, it is highlighted interlinked and an economic update in any part of the world affects the market immediately – both a positive and negative impact.

Forex trading in Canada

Foreign exchange trading is considered lawful in Canada and the market is regulated and supervised by the Investment Industry Regulatory Organization of Canada (IIROC), which was christened in 2008 by merging the Investment Dealers Association of Canada (IDA) and Market Regulation Services Inc. (RS).

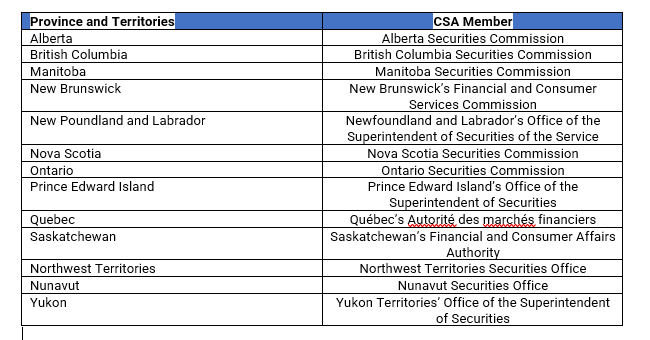

Each [province in Canada is managed by each securities regulator that is under the Canadian Securities Administrators.

Are there any Canadian Trading Platforms that support Forex Trading?

A number of trading platforms are available for Canadians to trade in foreign exchange. We have listed some below:

- IFC Markets

- FXCC

- Forex.com

- Interactive Brokers

- Ava Trade

- CIIC Markets

- Saxo Bank

- Fpmarkets

- HYCM

- Backbull

- Eightcap

- Vt markets

- Legacy FX

Canadian Forex trading Platforms

There are a number of Forex trading platforms available to the Canadians. You are required to do complete research into all the platforms, compare their fees, minimum balance, features, regulatory body etc., before commencing an account.

A novice in forex trading must primarily have knowledge of the markets and its happening, do an analysis of the market, forecast, develop a plan based on the analysis, execute the plan and know their limits.

Ask Your Query for FREE, Get quick answers from our FINTRAKK community!

Discussion (0)

Based on our analysis, Questrade seems to be the best day trading broker in Canada. It offers a dedicated intra day trader tool which enables you to be well-informed about the markets.

Based on our analysis Wealthsimple is a good alternative to Questrade for its cost effectiveness and Qtrade is a good alternative for Questrade for its customer services and research tools.

There are many steps in Forex trading. Determine your goals, complete research, open a Forex trading account, fund the account and commence trading.

We compared top three Forex brokers in Canada, based on various factors like its regulator, commission, pip, minimum deposit, etc. We believe that Ava Trade is the best Forex broker in Canada.

There are several choices available to Canadians who want to invest in the stock market online. Questrade ranks higher a sone of the best stock trading site for a beginner in Canada, offering access to both the Canadian and American stock markets.

Forex trading is completely legal in Canada. But before going with any broker, be sure the broker is licensed by the IIROC or authorized locally by a regional regulator.

Discover the most affordable option for stock trading platform in Canada with our information highlight on the cheapest stock trading platform available. Make informed decisions and save money on every trade with our top recommendations.

You are required to complete Know your customer rules and validate the details by Identification proofs. Once done, you need to fund your account with at least the minimum deposit to activate your Forex trading account in Canada.

No, you cannot use Robinhood in Canada. Only United States citizens, US permanent residents or those with a valid United States visa can sign up for a Robinhood account.

Forex trading in Canada is purchasing selling the Canadian Dollars with pairs such as US dollars, Great Britain Pounds, Euros etc., It is overseen by Investment Industry Regulatory Organization of Canada (IIROC).